General Information

All travel must be prior approved via a Travel Request. Travel expenditures that were not prior approved may become the personal responsibility of the traveler. Travel reimbursements must be requested within 60 days of the trip return date. Failure to meet this deadline will result in the trip not being reimbursed.

If you wish to purchase your airline ticket out-of-pocket, you may use your Bank of America Corporate Card, personal credit/debit card if it has higher insurance coverage or cash. Your department business administrator will be able to advise you on travel-related procedures.

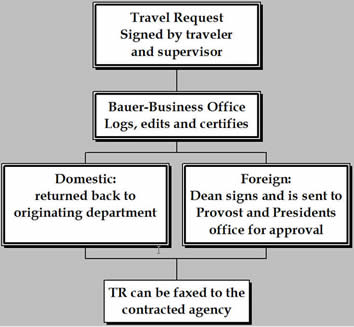

State/Foreign Travel TR should be sent to President and Provost for signature.

Local/Foreign Travel TR should be sent to President and Provost for signature.

Washington DC Travel If State funds are used, a form must be submitted to Austin on the internet 7 days in advance of trip.

Travel Process

Back to Top

Grant Travel Rules

Domestic Travel

The University of Houston’s institutional travel policy (MAPP4.02.01B) generally governs the reimbursement of research-related domestic travel expenses. In some instances, however, the sponsoring agency may impose more restrictive travel regulations. If so, the agency's regulations must be followed. Only the contracting officer of the funding agency has the authority to allow any exceptions to agency policy. If a P.I. wishes to obtain the sponsor’s approval of an exception to agency travel rules, he or she should write a letter requesting the exception and forward the letter to the Office of Contracts and Grants for co-signature and processing.

Foreign Travel

The definition of foreign travel may differ from sponsor to sponsor. Therefore, each award must be examined for this definition. For example, many agencies do not consider travel to Mexico and Canada as foreign travel. The award must also be examined for prior approval requirements, if any. Prior approval, when required, is often given only on a trip-by-trip basis. The P.I. who wishes to obtain the sponsor’s approval for foreign travel should write a letter requesting approval for the trip and should forward it to the Office of Contracts and Grants for co-signature and processing.

The University of Houston’s institutional travel policy (MAPP4.02.01B) generally governs the reimbursement of research-related foreign travel expenses. Each award must be examined, however, to see if the sponsor has specific regulations about the reimbursement of foreign travel expenses.

Section 5 of the International Air Transportation Act of 1974 (49 U.S.C. 40118) requires travelers to use U.S. flag air carriers (or carriers under a code-sharing arrangement with a U.S. flag air carrier) to the maximum extent possible when commercial air transportation is the means of travel between the United States and a foreign country or between foreign countries and when travel is supported, in whole or in part, by a federal grant or contract. This requirement may not be influenced by factors of cost, convenience, or personal travel preference, and because it is a law and not a regulation, it cannot be waived by the University or by the sponsoring agency.

Travel Charged to Two or More Budgets

Auditors carefully review travel charges that are split between two or more budgets so as to be sure that charges have been properly allocated. When preparing your travel voucher, it is important to be clear about the purpose of the trip and the distribution of charges. The voucher must indicate the primary purpose of the trip along with the project or budget that was the primary beneficiary of the trip. This information is necessary to justify the division of transportation and per diem expenses. Additionally, each day's activities and expenses must be listed and correlated to a specific project. Please see the attached worksheet, which will help document travel charges to more than one account.

Travel Advances

Under certain conditions, the University of Houston will approve travel advances for group travel and for individual foreign travel. (See MAPP04.02.01B.) In those cases, Accounts Payable requires that a department local cost center be used for the advance. It is important to note that a sponsored project cost center may not be used to cover the amount of the advance.

Back to Top

Travel Insurance

Domestic

UH Business Travel Insurance affords accidental Death and Dismemberment benefits to employees traveling on UH business. All that is needed to participate in this coverage is a completed, pre-approved travel request.

Foreign

The University of Houston System has in place a foreign travel insurance program. This program provides insurance coverage for faculty, students, and staff and other travelers while traveling abroad. The elements of the coverage are as follows:

FOREIGN GENERAL LIABILITY This provides coverage for the University if found liable for personal injury or damages to premises or property of others.

FOREIGN AUTOMOBILE LIABILITY This provides coverage for hired and non owned autos. In the event of an accident it will protect the University from liability if found to be liable for losses related to the rented or hired vehicles.

ACCIDENTAL DEATH AND DISMEMBERMENT This provides benefits to the traveler or beneficiaries in the event of serious injury or death.

ACCIDENT AND SICKNESS MEDICAL EXPENSES This covers medical expenses if the traveler becomes injured or ill while traveling abroad.

EMERGENCY MEDICAL EVACUATION This will pay for evacuation to a medical care facility in the event of a serious accident or illness. Also covers evacuation to the home country if necessary.

EMERGENCY FAMILY TRAVEL This will provide funds for family members to travel to the foreign location should the traveler become seriously ill or injured and cannot be evacuated.

REPATRIATION OF REMAINS This provides coverage to return the traveler’s remains to the home country in the event of death during a trip.

INSTRUCTIONS TO BUY INSURANCE

For this coverage to be placed into effect you must notify the Environmental Health and Risk Management Department (EHRM) at least two weeks in advance of your trip. There is a fee associated with this coverage and it will be dependant upon the number of travelers, locations and the duration of the trip. Please contact BIlly Underwood, Rick Management Administrator for insurance coverage request form and return it to EHRM for coverage to be in effect.

Per Diems & Mileage

Per diem is Latin for "per day" or "for each day." In the case of UH travel, it refers to the daily rate allowed for reimbursement of meals or lodging during a trip. A trip is defined as any destination farther than 60 miles from Houston, which lasts for at least one night’s stay. Per diem rates can be used when a traveler does not provide itemized receipts for meal expenses. The amount claimed should be equal to the traveler’s best recollection of the actual meal price, not to exceed the specific per diem rate for that city. If itemized receipts are submitted, the full amount of the meal can be claimed, even if it exceeds the per diem amount.

In-State Per Diem Rates

Out-Of-State Per Diem Rates

Foreign Per Diem Rates

Current Mileage Rate

Back to Top

Non-Overnight Trips

When to Use Account 54807, Non-Overnight Transportation

Account 54807 should be used if all of the following conditions are met:

1. Payment for an employee and/or student (not a regent, prospective employee, contractor, or university guest).

2. The payment is made with local (not state appropriated) funds.

3. The payment is not associated with an overnight trip.

4. The payment is for one or more of the following expenses:

• Mileage in a personally owned or leased vehicle

• Parking

• Tolls

• Public transportation (i.e., bus, rail, etc.) and taxi in the Houston metropolitan area

How to Process Non-Overnight Transportation Reimbursements

1. Use a regular (PCC 9) voucher.

2. For mileage, attach a completed Mileage Report (template on the AP Travel page) or a printout of a web mileage calculator, such as Mapquest, which indicates the point-to-point mileage.

3. Attach receipts for parking, tolls, public transportation, and taxi. If a receipt was not provided, write an explanation including the date, time, and amount of the expense.

4. Indicate the business purpose of each expense.

5. Obtain the signature or email approval of the employee/student and their supervisor/unit head.

6. Travel Request is not required.

Non-Overnight Mileage – Allowed vs. Not Allowed

In the following examples, UH is considered to be the employee’s regular place of work.

Allowed non-overnight mileage reimbursement includes:

• Drive from UH to a business meeting and back to UH

• Drive from home to a business meeting (not at UH) or from a business meeting (not at UH) to home only to the extent that the mileage exceeds the distance between home and UH

• Drive from home to a temporary work location (expected to last 1 year or less) and back home

• Drive from UH to a temporary work location and back to UH

NOT allowed non-overnight mileage reimbursement includes:

• Drive from home to UH or from UH to home, which is considered a non-reimbursable commuting expense

• Drive to non-business destinations before, during, or after driving to a business destination

o Example: If traveling from UH to the Galleria to do some shopping on your lunch hour and from the Galleria to downtown Houston for a business meeting and then back to UH, you could only claim the mileage from UH directly to the business meeting in downtown and back to UH.