Latest News

Predicting Future Currency Returns

Bauer Researcher Looks at Predictive Information for Giant Market Behavior

Published on June 15, 2021

Researching the largest financial trading market in the world is a challenge nearly as huge as the 24-hour, seven days a week market itself.

In the FX market, $6.6 trillion is traded each day by a diverse set of key market participants, ranging from corporations to mutual funds, and from central banks to hedge funds, making FX volume over 10 times larger than global equity market volume.

But despite the size and importance of the FX market, its decentralized, over the counter (OTC) structure has made it nearly impossible to study empirically. While information on trading activity of individual stocks is publicly available, the same information for the FX market is not.

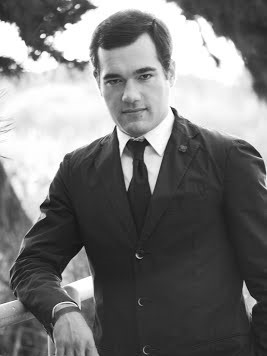

A FinTech expert from the C. T. Bauer College of Business, Assistant Professor of Finance Antonio Gargano, forged a partnership with the world's largest FX settlement institution that has yielded some of the first economically valuable, predictive information about how the giant market behaves.

“Our main findings are that FX volume contains information useful to predict future currency returns and the returns generated by the proposed strategy are unrelated to the returns of other common currency trading strategies, offering strong diversification benefits,” Gargano said. “This is very valuable for institutional investors.”

The CLS Group data used in the study covers around 50 percent of OTC spot, forward, and swap market activity for 31 currency pairs, over six years, at an hourly frequency.

“We proposed an academic collaboration whereby they give access to the data and we write a breakthrough paper. CLS has since used our paper to make their data known to a broad audience, making it a mutually beneficial collaboration.” Gargano explained.

“Investors in the FX market are very keen to get an information advantage, and this data clearly offers one.”

“Foreign Exchange Volume,” the article in which Gargano and three co-authors describe a testable relationship between FX volume and future currency returns, has been accepted for publication in the top financial journal, Review of Financial Studies.

Gargano joined the Bauer College in 2020 and, conducts research in the areas of Household Finance, FinTech, Information, and Financial Econometrics. He has established academic collaborations with Gimme5 (an Italian FinTech Company), realestate.com.au (the largest real estate listing website in Australia), S3 Partners (a FinTech and data company in NYC) and TD Ameritrade.

Gargano was previously an Associate Professor of Finance at the University of Melbourne. His research has been published widely in highly respected academic journals, including the Review of Financial Studies, Management Science, and the Journal of Econometrics, and featured by several major news outlets (Reuters, CNBC, and Business Insider and others). Gargano has received several prestigious awards, including the Michael J. Brennan Award for best paper in the Review of Financial Studies in 2018; and the PanAgora Asset Management Crowell Prize in 2016. He has received research grants from INQUIRE Europe, the Fondecyt Foundation, and the Lusk Center, among others.

Gargano received his Ph.D. in Finance from Bocconi University, a master’s degree from the University of Pisa and a BA in philosophy from the University of Naples Federico II. He also worked as a junior portfolio manager at an asset management company in Italy.