Houston Updates

-

Archive

- June 2025

- March 2025

- December 10, 2024

- September 14, 2024

- May 21, 2024

- March 19, 2024

- December 9, 2023

- June 16, 2023

- April 6, 2023

- March 17, 2023

- Dec. 19, 2022

- Sept. 14, 2022

- July 4, 2022

- March 27, 2022

- March 9, 2022

- September 2021

- April 2021

- March 2021

- September 2020

- August 2020

- June 2020

- April 2020

- March 2020

- January 2020

- December 2018

- June 2018

- March 2018

- February 2018

- January 2018

- September 2017

- September 2017 Post-Hurricane

- June 2017

- March 2017

- January 2017

- September 2016

- March 2016

- December 2015

- September 2015

- June 2015

- March 2015

- December 2014

- June 2014

- March 2014

- November 2013

- September 2013

A Soft-Landing for Houston Led by Moderating US Growth: A Return to Trend After a Solid 2024

May 21, 2024

In our March 19 update on Houston’s economy we described a long slowdown underway in both the US and Houston. The slowdown began with the restoration of jobs lost to the lockdowns during the second quarter of 2022, some 364,000 in Houston and 22.9 million in the US. Some catch-up in job growth was still needed, however, as the early 2022 economy had only returned to pre-pandemic levels and still needed to add jobs making up for 2020, 2021 and early 2022. But even that backlog now seems to be filled, and it is time for a soft landing and a return to normal trends.

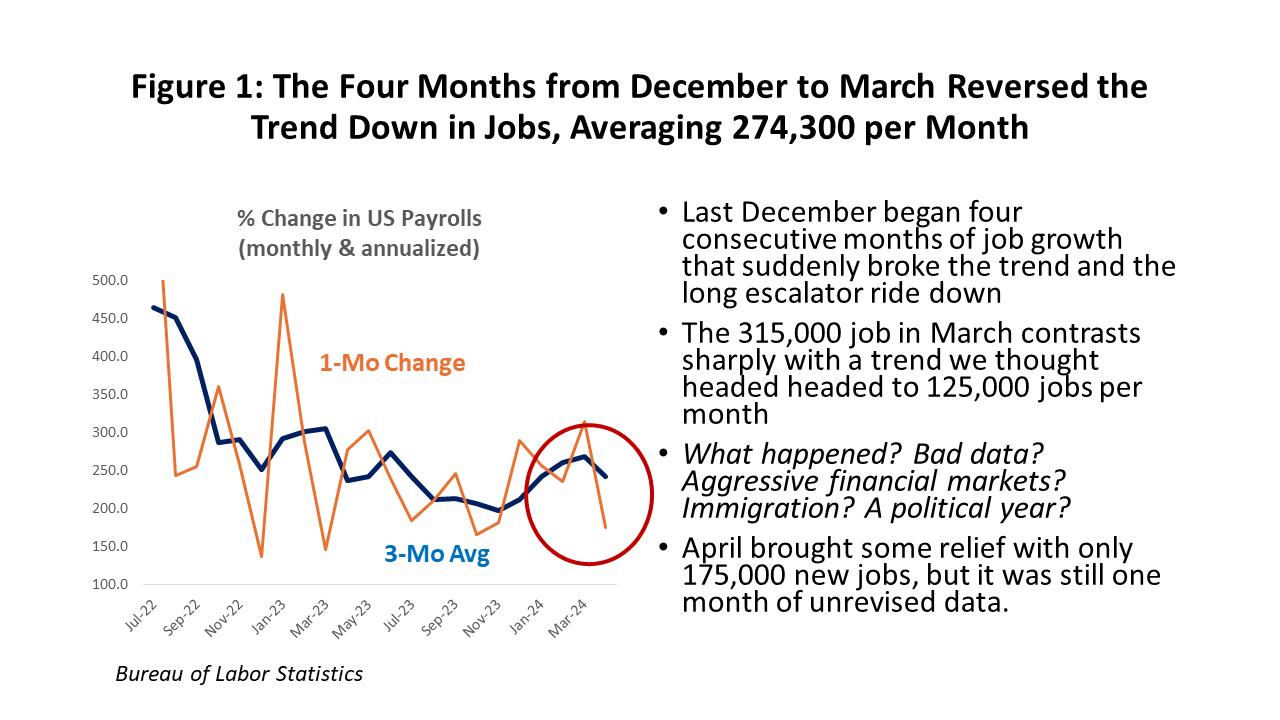

Although Houston recently received a large bump up from data revisions to its 2023 job growth, metro area payrolls continued a steady slowing trend this spring, while the US unexpectedly saw jobs accelerate beginning in December of last year. After adding 182,000 new jobs in November, the US suddenly added an average 274,300 monthly jobs through March. This could only be seen as an unwelcome threat to inflation by the Federal Reserve. April showed an increase of only 175,000 jobs, but it remains an unrevised one-month change. Plus, April and March are always difficult to estimate because of the Easter holiday.

The blue line in Figure 1 shows a smoothed 3-month average of monthly US payroll changes. The long trend downward seemed in place as the US economy prepared for a soft landing last November, only to see a lift-off in following months. Where did the reacceleration come from? Immigration is often offered as one explanation, as is election-year politics for another. Pumping up the economy has been a tactic employed by both parties in recent election cycles, but it would likely be a mistake this time by forcing interest rates higher for longer at a critical time.

The US Outlook: Faster Or Slower Growth Ahead?

To answer this question, our forecast relies heavily on the short-run US forecast from the Survey of Professional Forecasters. The SPF is the oldest quarterly survey among US economic outlooks. It was compiled and published by the NBER from 1960 to 1990, when the Federal Reserve Bank of Philadelphia was asked to take it over. Its results are published quarterly on the Philadelphia Fed website.

The survey response comes from at least 35-40 professional macroeconomic forecasting groups that acknowledge their regular participation, plus an unknown number of others that remain anonymous. Respondents are from academics, consulting, banking, and industry. Compare this to the general survey of National Association of Business Economics membership who may or may not be forecasters or to the heavy financial-sector participation of the Wall Street Journal’s outlook survey.

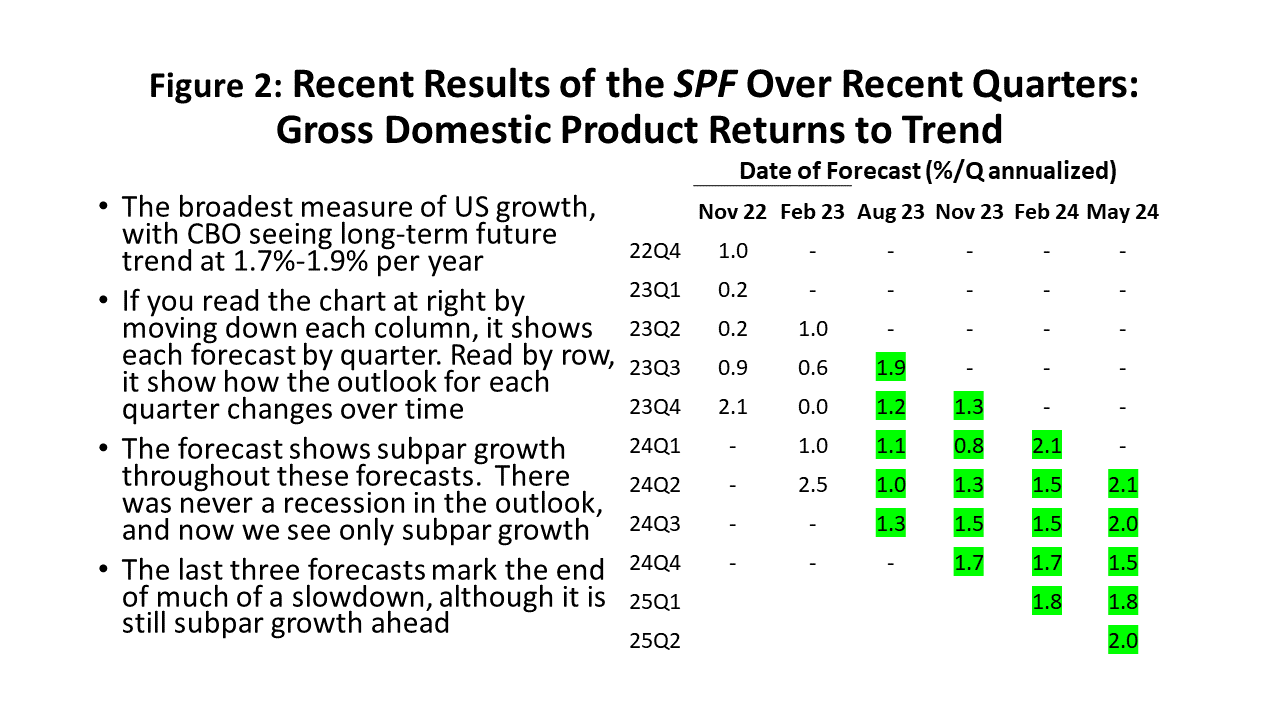

In past cycles, the result of the Fed raising interest rates enough to halt inflation has been recession. Despite sharply rising interest rates through 2022, the SPF forecast no recession but only a sharp slowdown. Figure 2 shows the results of the Survey over six of the last seven quarters for gross domestic product (GDP), the broadest measure of the economy. May 2024 is the latest release. The economy was expected to weaken steadily according to forecasts released through mid-2023, but the projections then turned around with four-quarter growth seen as improving steadily from 1.2% in August of last year, to 1.3%, to 1.6%, and finally 1.8 percent this May. This latest forecast looks like a soft landing is in the works.

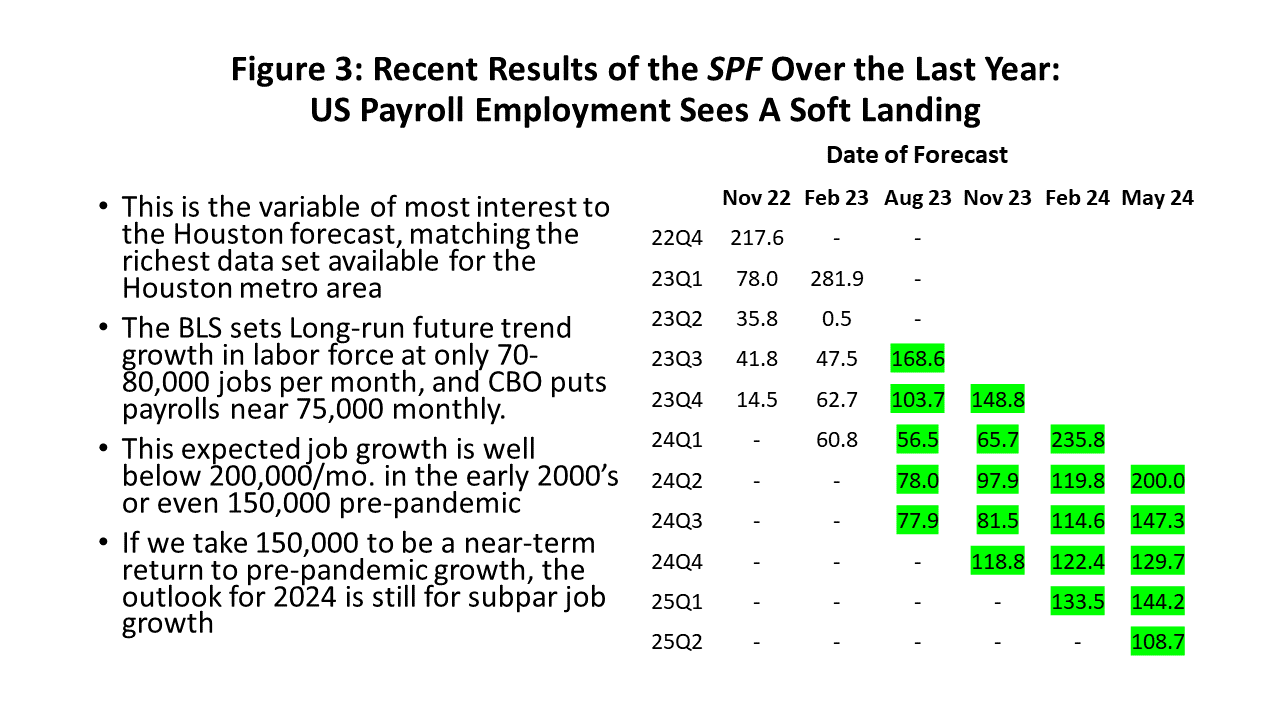

What about the unexpected acceleration of job growth beginning last December? In Figure 3, we see forecast payroll employment from the SPF, and their consensus is that it goes away quickly with slower trend employment growth returning just as fast.

The jobs data is of special interest because of Houston. Regional economic data are limited compared to the wide-ranging and detailed data available for the US. In Houston, GDP and personal income figures are published only once a year, for example. Payroll employment, in contrast, is available monthly and provides substantial industry detail that allows a broad comparison of Houston to US performance.

Our March 19 report offered two possible reasons why job growth picked up so sharply last year. One was the surge in immigration across the southern border in 2022 and 2023 which was featured in recent reports from the Congressional Budget Office and the Brookings Institution. The Brookings report did not directly address the first quarter pickup, but it found that immigration could explain a small part of the extraordinary strength of job growth throughout the pandemic recovery – and that loose fiscal policy through 2022-23 was the likely factor in the difference. The Inflation Reduction Act, the CHIPS and Science Act and Bipartisan Infrastructure Act are all at work in this political year (Figure 4), but the current SPF outlook sees the 2024Q1 pickup as only a temporary bump in the road.

The US Consumer

The key to the US economy has been the consumer since the pandemic began. The history is summarized at length in our forecast from last March. The pandemic brought two waves of fiscal spending in 2020 and 2021 and delivered a combined $5.0 trillion or over $30,000 per American family. This spending mostly ended in late 2021 and early 2022, but as much as $2 trillion in cash and other highly liquid assets had stacked up in consumer bank accounts, allowing them to spend even as pandemic monies disappeared. Now, even these excess savings seem to have disappeared. The bottom 50% of the income distribution holds only three percent of what is left while the top 10% holds 75 percent.

In April, a ConsumerSignals report from Deloitte found total consumer spending holding steady and barely down over the last year. However, higher spending now comes in essential categories like housing, utilities, and gasoline, while spending weakens across discretionary sectors like clothing and even groceries. Discretionary travel expenditure remains very strong, likely reflecting the cash still held at the top of the income distribution.

Bank of America in March found few signs of consumer stress. Debit and credit card spending was up only one percent over last year, and up only 2 percent for low-income families. Savings and checking balances remain healthy for all groups. Borrowing against retirement plans or taking a hardship distribution has risen little since last year.

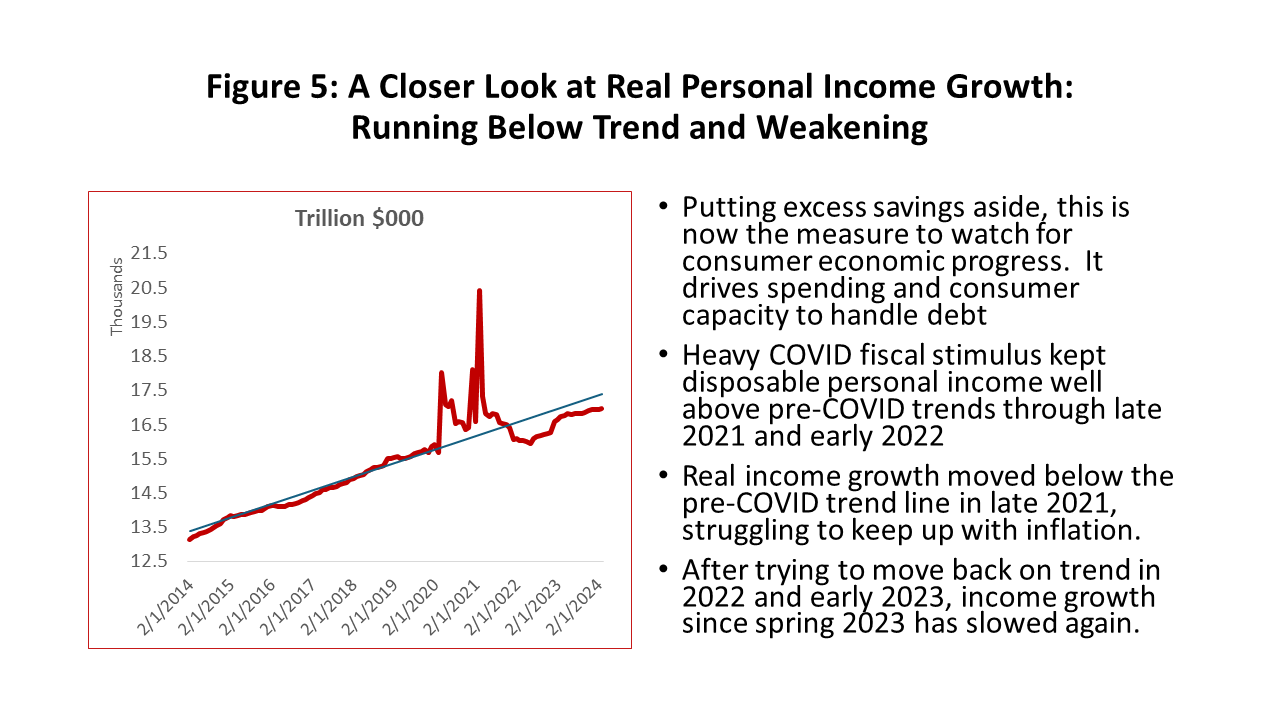

Figure 5 shows recent developments in the most basic support for consumer spending – inflation-adjusted personal income after taxes. We see this measure trending upward at pre-COVID rates, interrupted twice by COVID stimulus, and recovering to income levels that run below trend. Income falls back with the initial big cuts in COVID spending, tries to recover in 2022, but again fell below trend growth last year.

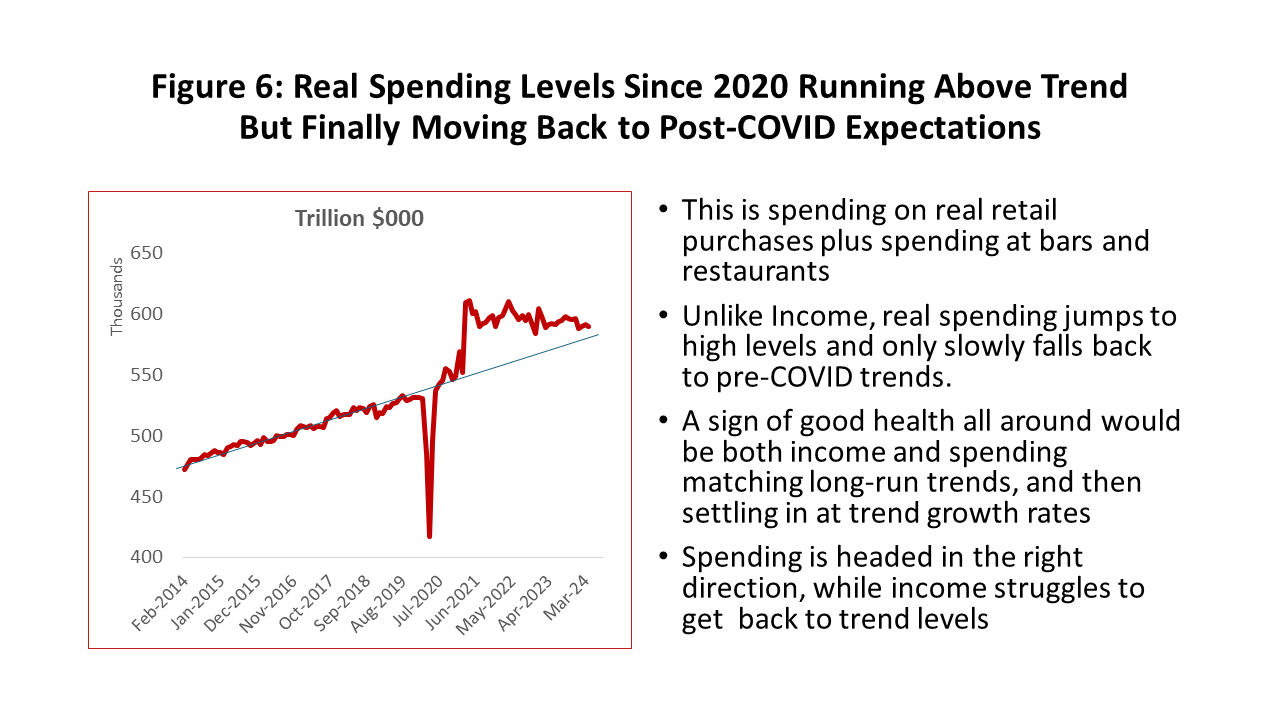

Meanwhile, inflation-adjusted US spending in Figure 6 never fell below trend after the lockdowns, although it is approaching that level rapidly. This is spending on retail sales and food and drink. Unlike income, we see very high levels of spending from 2020 simply holding on at high levels and waiting for trend growth to catch up. A good sign all around would be to see both series reach their proper level of trend growth and then settle in at these rates. Spending is headed in the right direction, while real income is struggling.

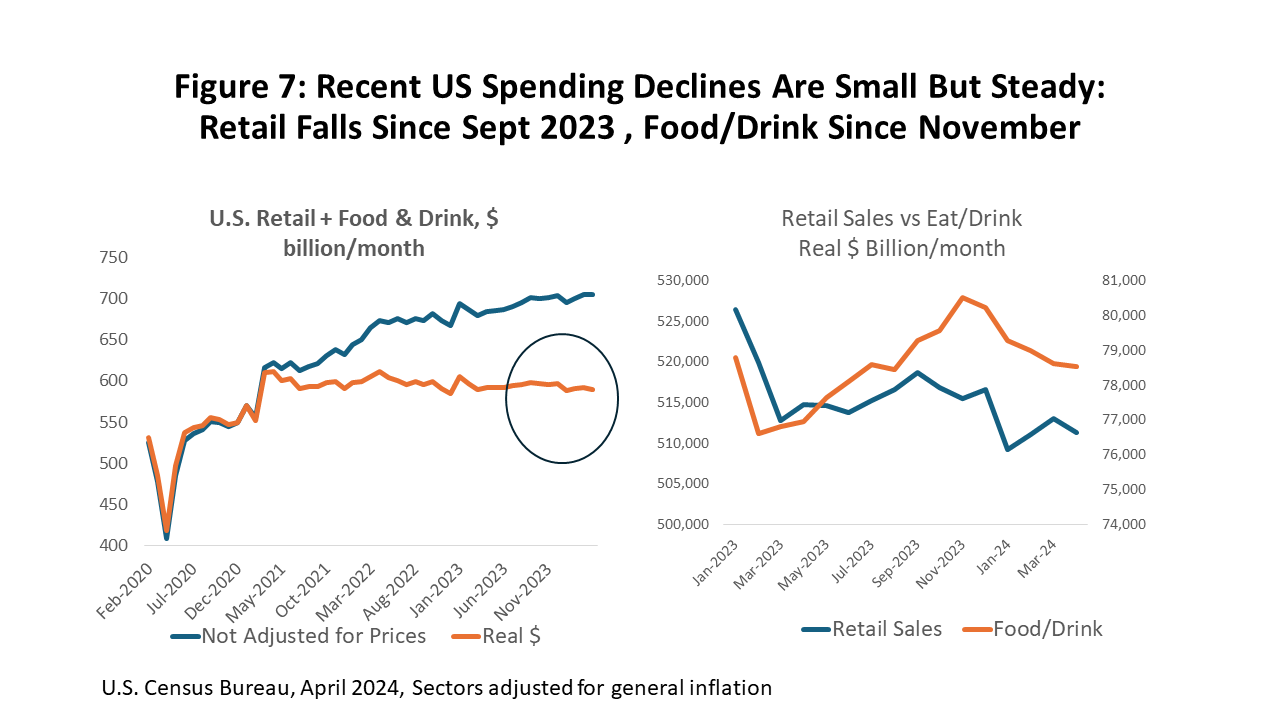

In Figure 7, we get a closer look at real and nominal retail sales since December 2019, including food and drink. The second and third round of stimulus arrived in late 2020 and early 2021, and real retail sales surged 10.3 percent between December 2020 and the following April. Since early 2020 they gave up virtually no ground over time despite falling real income.

The inflation-adjusted sales may have finally peaked in the last few months but has still given up only a couple of percentage points. Real retail spending began to fall back in September and eating and drinking places only in November.

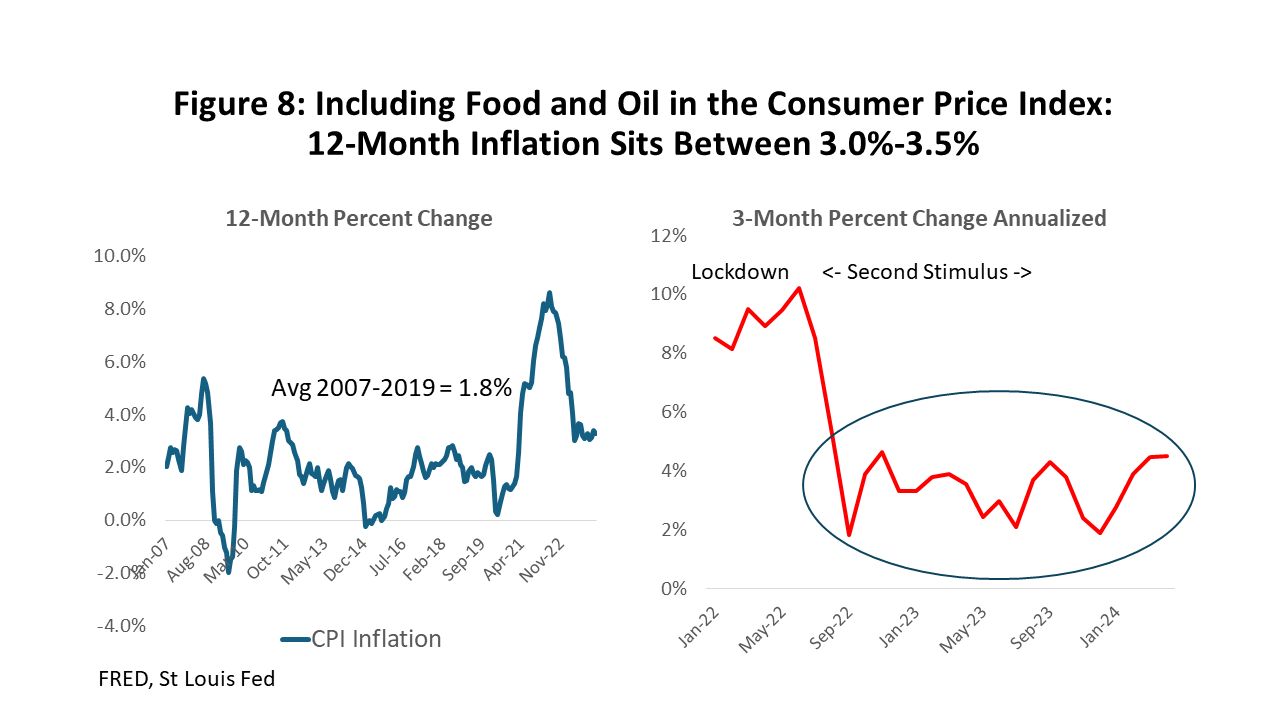

Monetary Policy Locked In for Now

The recent outbreak of inflation began in earnest in early 2021. After 15 years of the Federal Reserve failing to push inflation high enough to meet its 2.0 percent price target, it took only 15 months of pandemic price increases for CPI inflation to peak at 8.6 percent based on 12-month annual changes. (Figure 8) Rising oil and food prices following Russia’s invasion of Ukraine contributed strongly both to the CPI peak and to its fall to a current 3.3 percent. The 12-month changes have swung between three and four percent for nearly a year. On the basis of 3-month changes, the CPI briefly fell under two percent last December, but rising housing and energy prices have again pushed it above four percent.

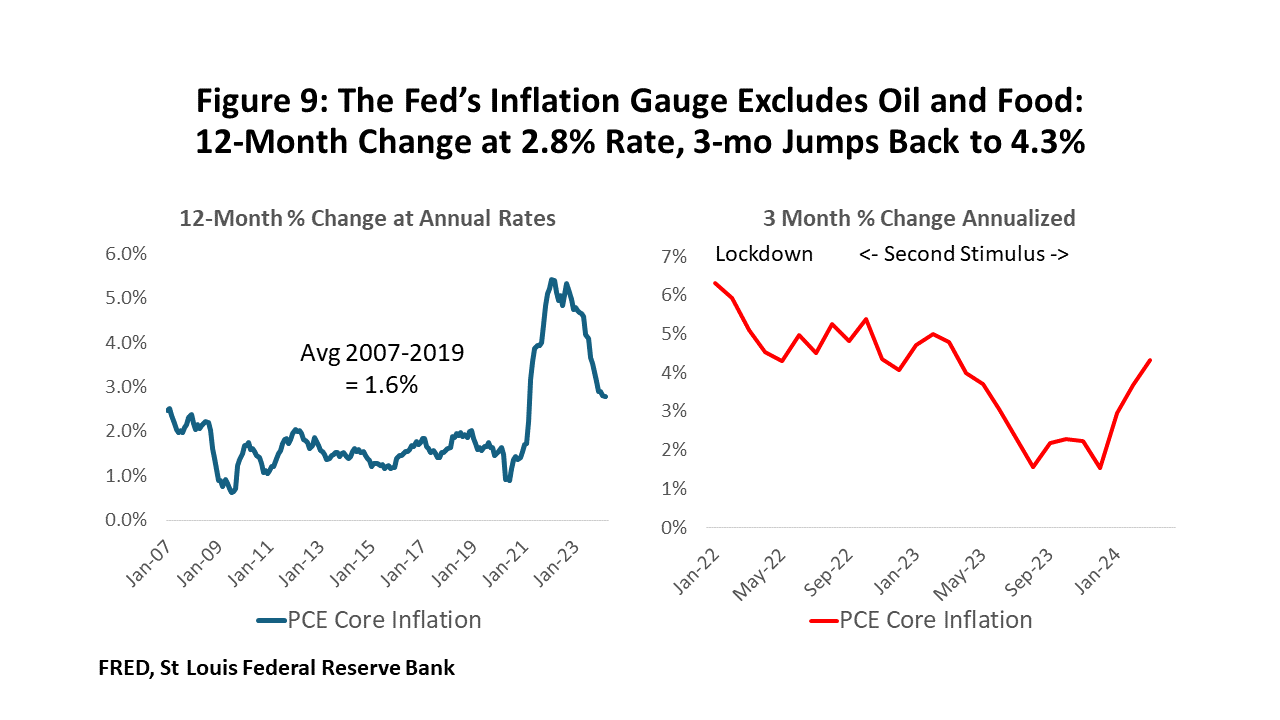

The Consumer Price Index is important as a measure of the price changes that all of us see at the department store, restaurant, grocery store, and gas station. But for policy purposes, the Federal Reserve uses another measure of price change and inflation. It turns to the personal consumption expenditure (PCE) deflator from the national income accounts, and it excludes volatile oil and food prices that are well out of the Fed’s control.

Figure 9 shows the core PCE at work. Like the CPI, for 15 years it failed to meet the two percent Fed target, and the PCE breakout and inflation peaks were timed much like the CPI. However, the Fed’s core PCE index saw prices rise to only 5.4 percent peak. While these lower prices are of little comfort to the consumer who lives with the reality of recent food and gasoline inflation, this is the measure the Fed uses to steer monetary policy.

Late last year, it looked like real progress was being made in bringing core PCE prices down. Based on the 12-month changes in the left side of Figure 9, price increases were steady at 2.8 to 2.9 percent, but using 3-month changes on the right side, the December data briefly showed a fall to an annualized 1.5 percent. However, a string of increases this year has pushed inflation sharply back up to a 4.3 percent annual rate.

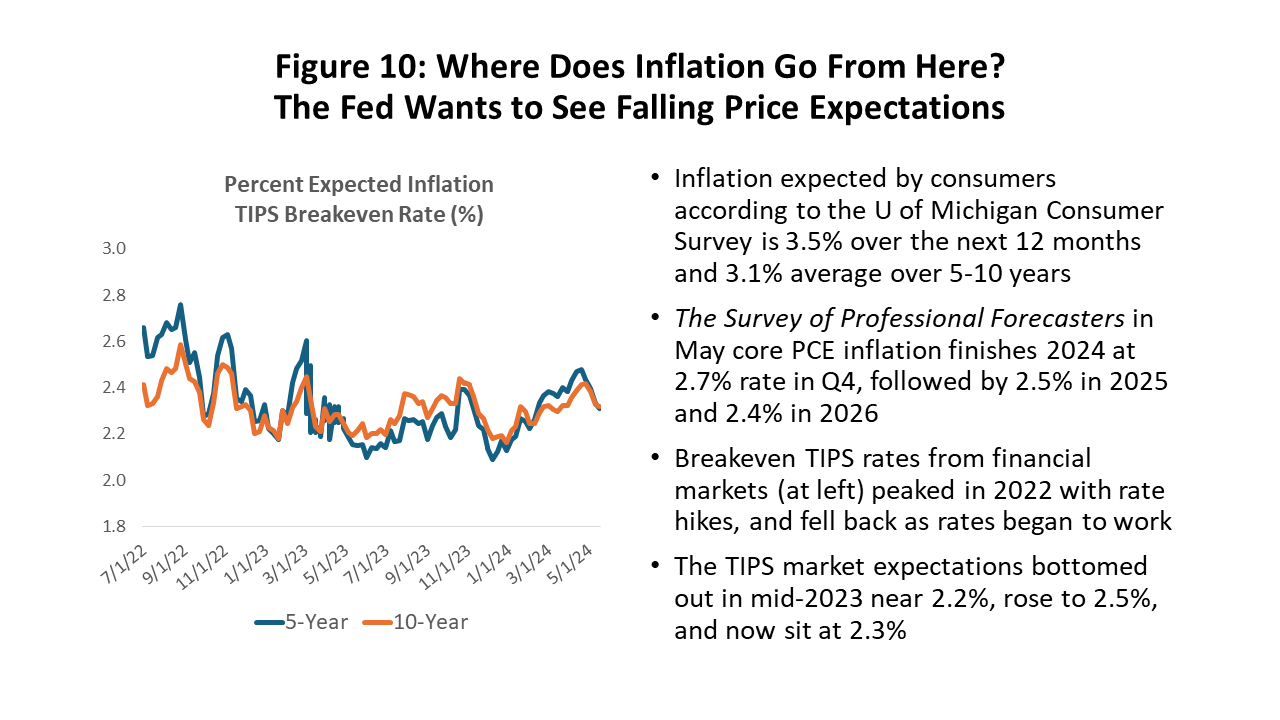

We continue to get mixed reports on where inflation is expected to go from here. Inflation expectations can become self-fulfilling and can slow the disinflation process, e.g., through higher collective bargaining demands. Consumers are always the least optimistic group, and this is reflected by the University of Michigan’s monthly survey of household price expectations. (Figure 10) Consumers currently see prices running 3.5 percent over the next twelve months and 3.1% over the coming five to ten. The SPF now sees core PCE inflation falling to only 2.7 percent this year and 2.5 in 2026. And by looking at the implied inflation rates from the market for the Treasury’s inflation-protected securities (TIPS), financial markets expect the next 5 or 10 years to bring inflation near 2.3 percent.

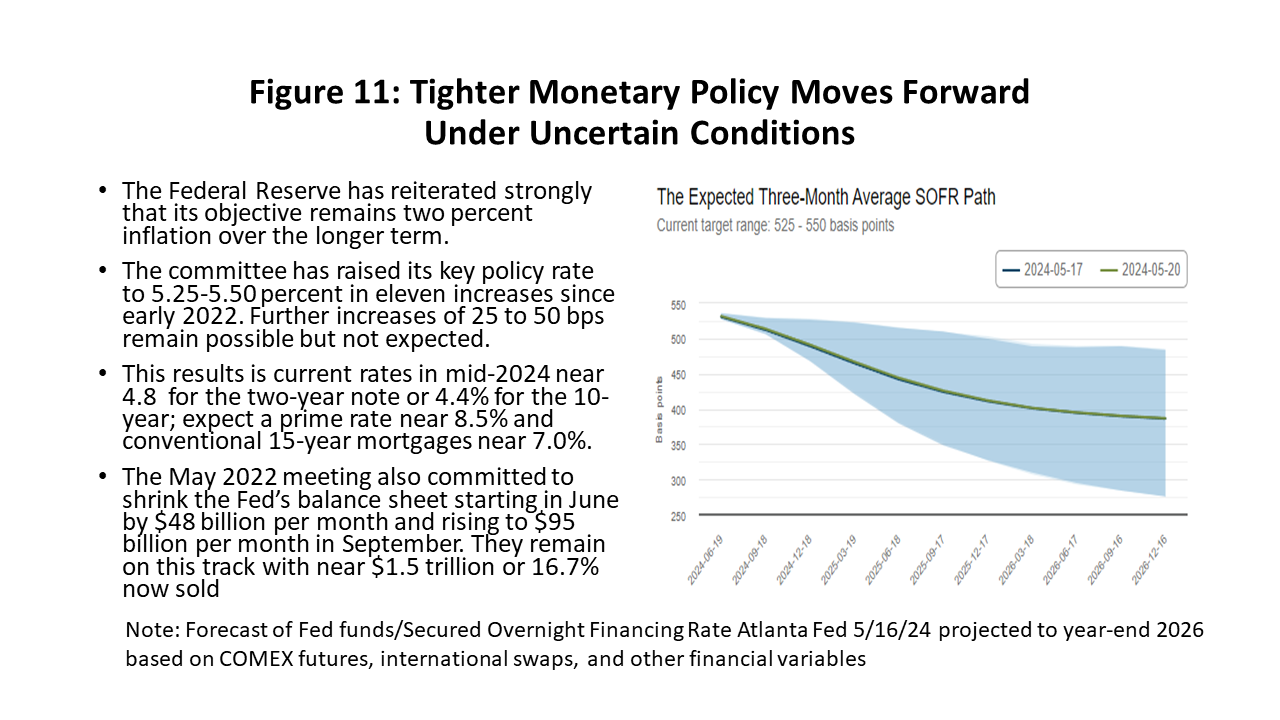

Figure 11 describes the Fed’s recent policy in terms of its 2.0 percent goal, its current position of holding rates steady, and continued efforts to shrink the balance sheet. Market rates stand near 4.8 percent for the 2-year treasury note and 4.4% for the 10-year, the prime rate at 8.8 percent, and a conventional 15-year mortgage at 7.0%.

In our last forecast, only the SPF held expectations that prices would quickly settle into the Fed’s two percent goal, and now even the SPF has now backed off such quick progress. This means pervasive doubts by consumers and markets that question the central bank’s credibility as an inflation fighter. These doubts also show up in the chart in the right side of Figure 11 which is a market-based Atlanta Fed forecast of the Secured Overnight Finance Rate (SOFR). Just think of SOFR as a proxy for federal funds based on the COMEX futures market and international swaps.

The SOFR expectations in our March outlook were for a series of rate cuts beginning in early 2024 that were roughly 25 basis points each quarter. Higher inflation and stronger job growth have now pushed market expectations to two 25 basis-point cuts And through the end of 2026, the markets see the Fed policy rate ending the year near 3.86 percent. If we combine the New York Fed’s estimates of the real neutral rate of interest at 1.23% with the market’s 3.86 percent policy rate, it implies inflation running near 2.7 percent through 2026. This remains well above the Fed’s 2% target and again shows the market’s continued doubts about the Fed’s willingness to do what is necessary to meet a 2% target.

Oil Markets and Oil Prices

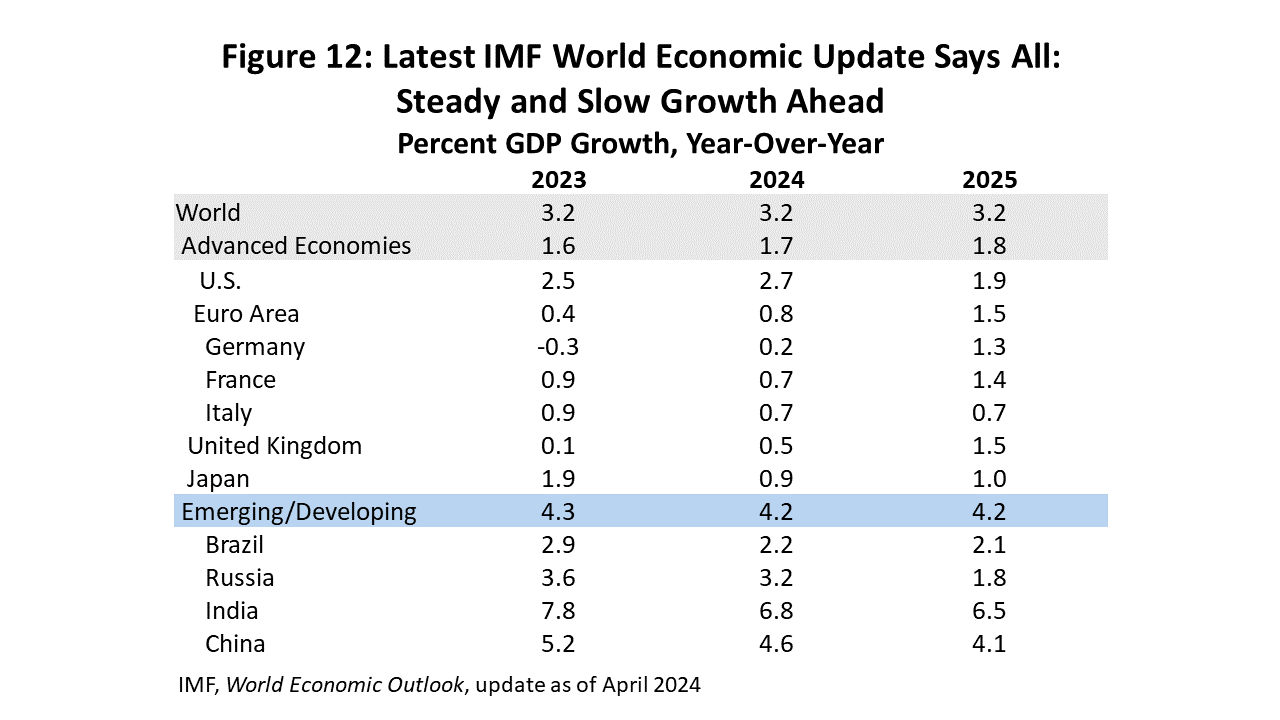

Upstream oil operates in a global market, and the IMF’s World Economic Outlook sees the near-term future as quite slow and staying slow through 2025. (Figure 12) Annual growth rates in GDP are 3.2 percent each year from 2023 to 2025. High interest rates weigh on all countries but declining rates should soon provide some relief for the developed world. However, many less developed countries piled on high levels of debt during the pandemic and will continue to struggle with high interest payments.

Advanced economies see a pickup in activity this year to only 1.9 percent from 1.6 percent last year, and then falling back to 1.7 percent next year. Europe generally improves as the Ukraine energy shock wears off, and Japan is expected to fall back but remain positive after normalization of its exchange rate and monetary policies. US GDP growth remains strong at 2.7 percent this year but slowing to 1.9 percent next year.

Less developed countries see collective growth that falls back from 4.3 percent this year to 4.1 percent in 2025. India enjoys growth above 6.5 percent throughout the period, led by rapid growth in its working-age population. China slides back to 4.1 percent in 2025 from 4.6 percent this year as its post-pandemic spending surge has ended and it tries to control speculative excesses in its property market.

If the global outlook is slow and stable, there is potential excitement from geopolitics in general and two hot wars in particular. Both the Russia-Ukraine war and the Hamas-Israel conflict closely involve oil market participants. Oil prices are supply inelastic, and a reduction in supply brings a spike in price that can last from a few weeks to a few months.

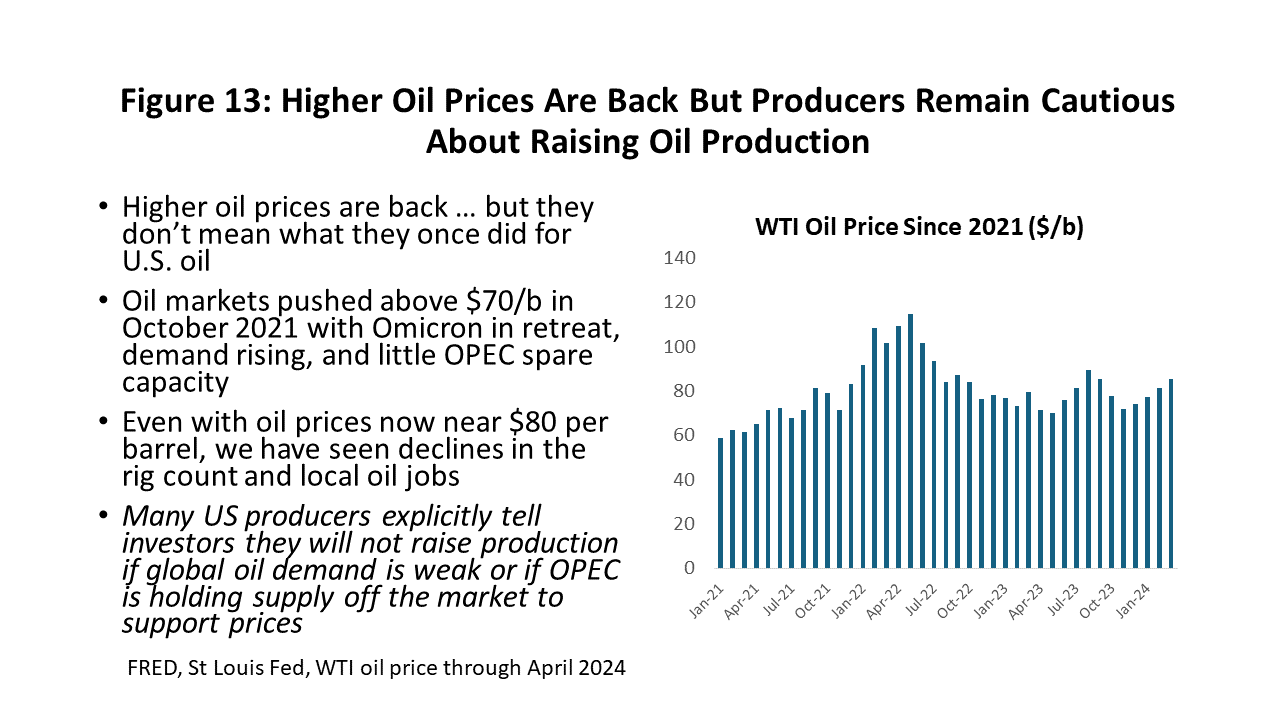

Post-COVID oil prices increased to $70/b by late 2021, drawing strength through the early post-pandemic era from a rapidly improving global economy, stronger travel demand, and increased power generation. OPEC would intervene in oil markets in 2022 and cut oil production in the face of a weakening global economy. There are currently active cuts 5.9 million barrels of oil per day, with 3.7 million in the official OPEC+ framework and 2.2 million of “voluntary” cuts from several countries led by Saudi Arabia. The effect has been to keep the price of oil steady near $80 per barrel, as these cuts were at least partially offset by increased production in Brazil, Guyana, and the US. (Figure 13)

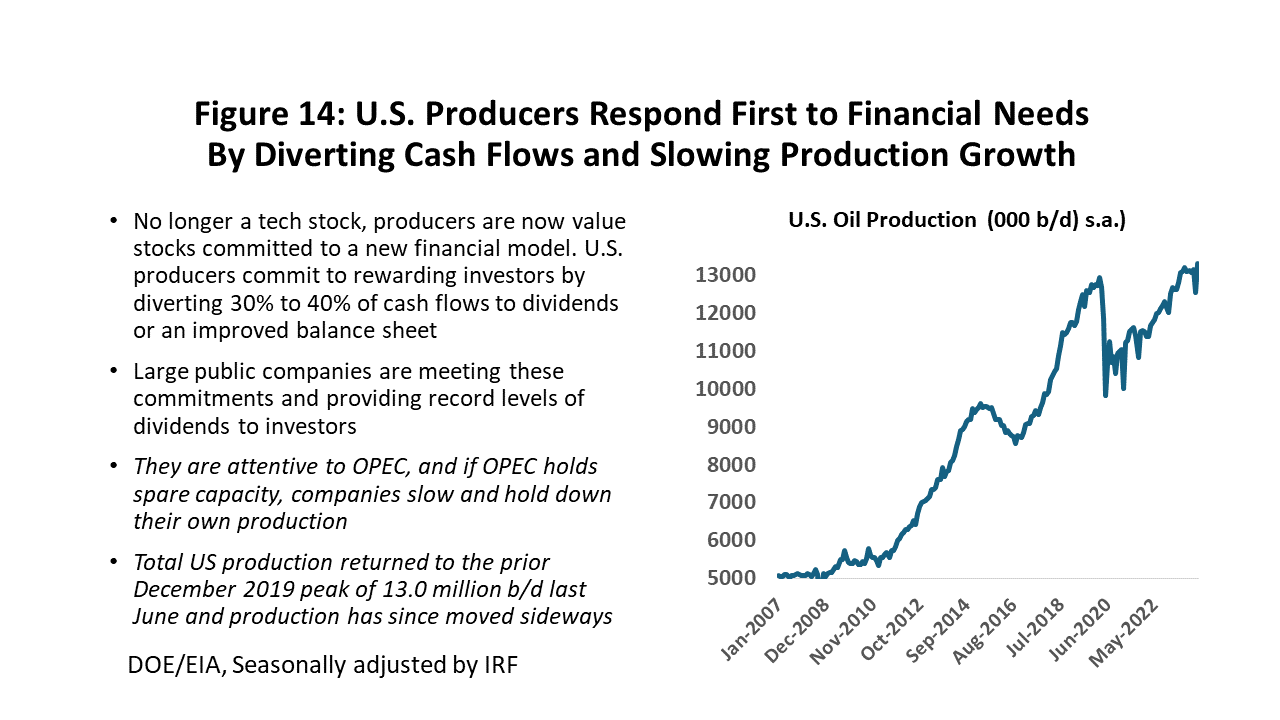

US oil production returned to new peak levels last June and has essentially moved sideways since that time. (Figure 14) This latest recovery to a prior peak level was a third slower than the recovery in production from 2016 to 2019, as US public companies kept a close eye on OPEC. It was OPEC that taught the fracking companies that they are a high-cost source of oil after the cartel cut prices three times from 2014-2020 and forced US producers through three rounds of bankruptcy. Some $295 billion in fracking assets went through the bankruptcy courts.

As a high-cost source of oil, fracking can no longer depend on rising equity as a source of financing. They now are value stocks that divert 30-40 percent of operational cash flows to paying dividends. Many companies tell their investors that they will not increase production as long as OPEC holds spare capacity. As a result of this new financial model, fracking is a smaller, slower-growing, and more stable industry.

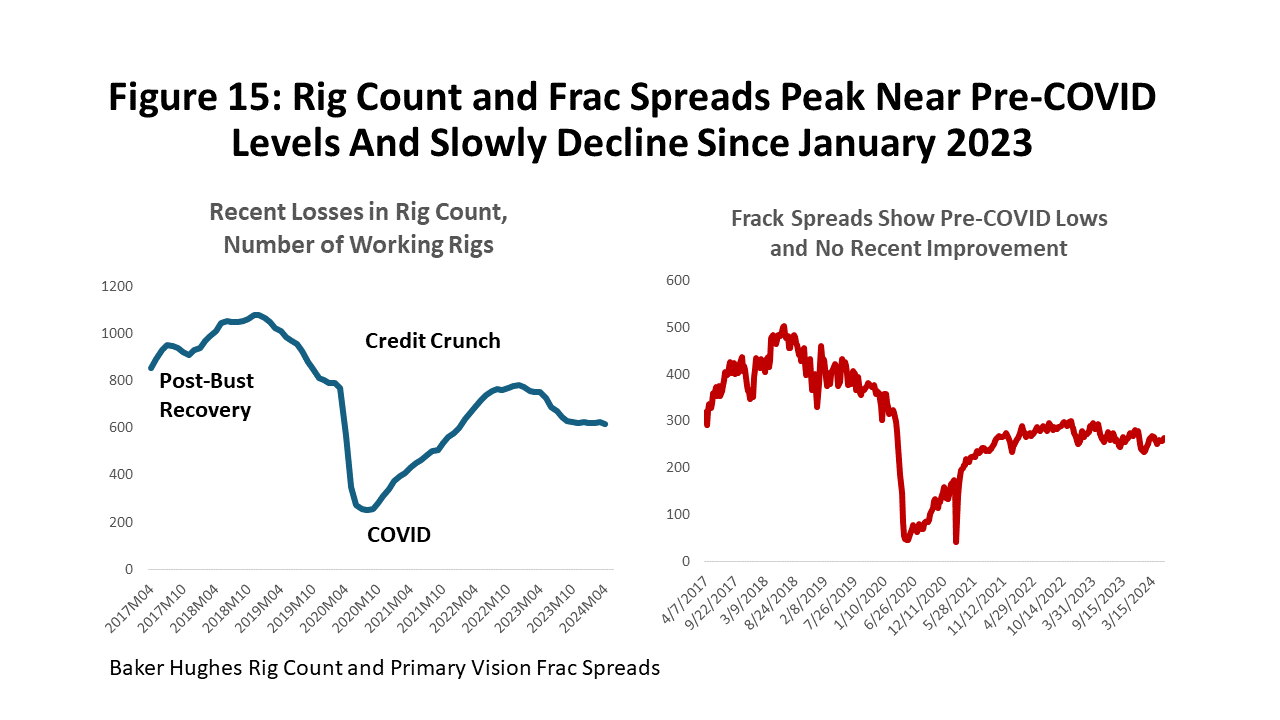

This combination of a new financial model and attention to OPEC spare capacity explains why there has been no rush back to the oil fields since 2020. (Figure 15) The rig count fell to near 760 before COVID arrived, and then rigs fell hard to an all-time low of 253 in the Saudi/Russia oil war. Recovery saw a brief return to 780 working rigs before falling yet again, and they are now down 20.9 percent. Frac spreads are the more modern measure of activity in the oil fields, but they tell much the same story – well down from pre-COVID levels and 4.4 percent below levels of last fall.

This decline in rigs and frac spreads has less to do with oil prices than rising interest rates. For large public companies, the new financial rules are firmly in place with strict capital discipline and investors getting paid first. Their scale allows them to drive big gains in productivity in fracking, hold onto rigs, and account for most of the recent increases in oil production.

The laggards are small private companies that can’t use the new model. Often relying on bank financing, they are now struggling with higher interest rates, lower-quality acreage, and an inability to capture the productivity gains of big competitors. Many large banks that finance fossil fuels are now getting out of the business. These private companies are shedding rigs, reducing drilling, and account for most current reverses. Cost escalation has slowed or stopped in the oilfields, but high cost and availability challenge labor and supplies.

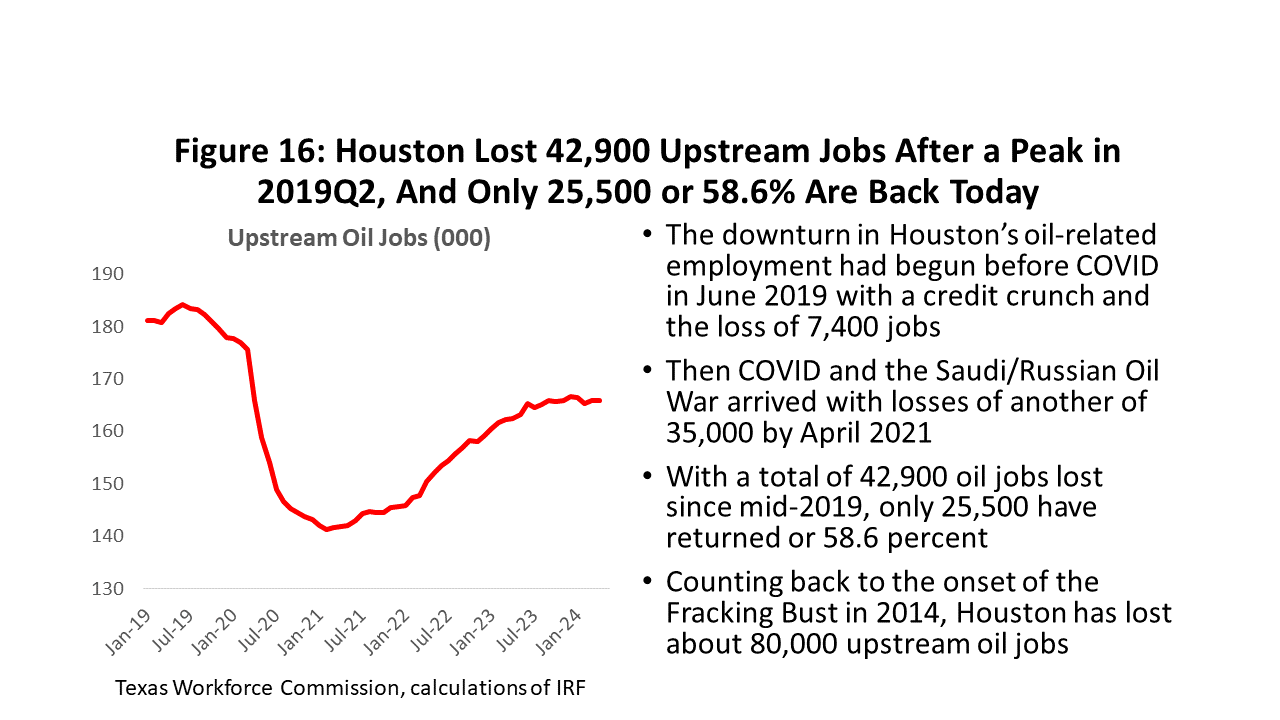

Oil-related employment in Houston has behaved much the same way as the rig count – slower and lower despite healthy oil prices. (Figure 16) After losing 43,000 upstream oil jobs to the 2018 credit crunch, COVID pandemic, and Saudi/Russia oil war, the return of these jobs continues at a slow pace. Only 21,100 oil jobs are back so far or 49.1 percent. If we begin counting from the end of the fracking boom in 2014, Houston has lost about 80,000 jobs in oil production, services, fabricated metal, and machinery. Again, this slow recovery in jobs is just one more sign that this is a cautious industry – smaller and slower-growing even with several years of $70 oil.

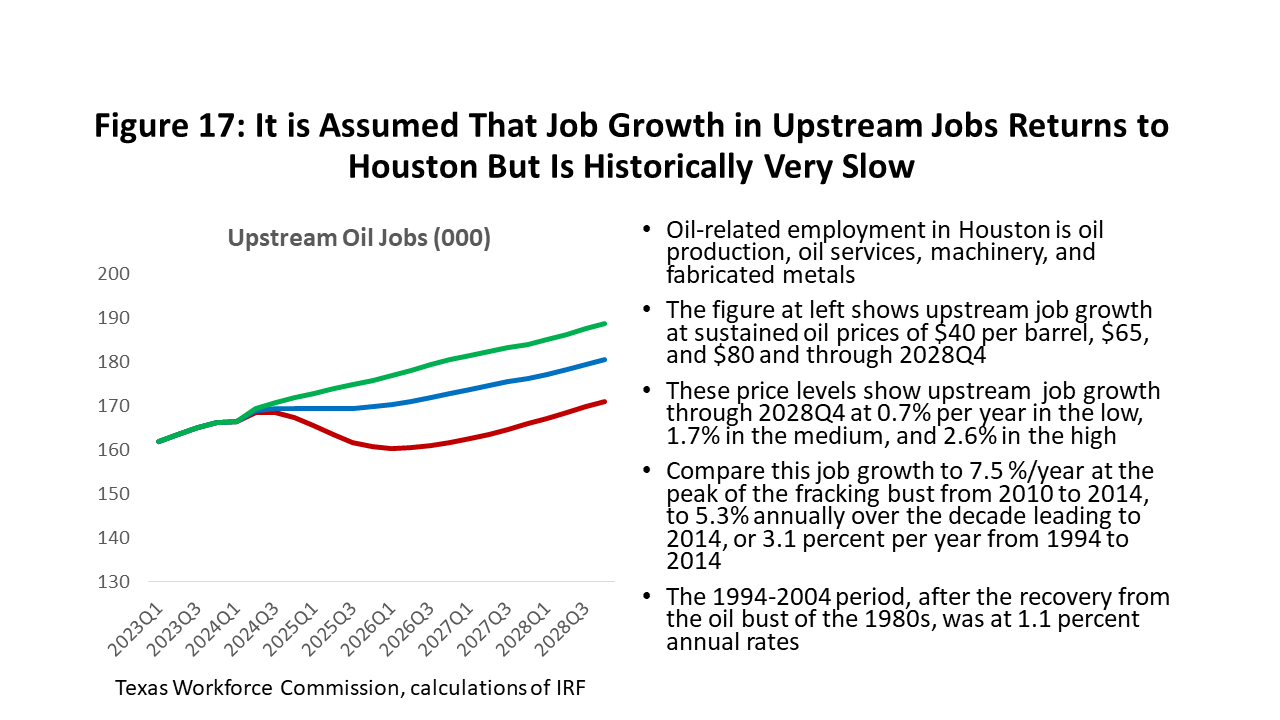

We assume that near-term upstream job growth resumes in Houston. How many jobs depends on what oil price we see: $40 for the low, $65 for the medium, or $80 for the high. See Figure 17. Oil-related employment is spread over local oil producers, oil services, machinery, and fabricated metals.

Our estimated employment growth from 2024Q1 to 2028Q4 averages 0.7 percent in the low forecast, 1.7 percent in the medium, and 2.6 percent in the high. This compares to 7.5 percent annually for the 2010-2014 period at the peak of the fracking boom, to 5.3 percent for the decade leading up to 2014, or to 3.1 percent for the two decades leading to 2014. The 1994-2004 decade that followed the oil bust of the 1980’s was a period of industry consolidation that saw oil jobs grow at only 1.1 percent per year.

How Is Houston Doing?

There is no question that Houston’s payroll employment has produced extraordinary growth in recent years. Its 2019 payroll employment growth was right on a typical trend pace at 59,400 or 1.7 percent. Then came the pandemic and the loss of 191,100 jobs year-over-year, the return of 163,900 in 2021, another 154,000 in 2022, and finally 109,800 last year. Once pandemic-era jobs were restored to their prior peak in April 2022, Houston moved into a new economic expansion and has since added another 223,400 jobs.

But we need to be careful in how we interpret these extraordinary job gains. First, cyclical recovery from a major downturn always should bring jobs back quickly, as labor and capital have been pushed to the sideline by recession. As soon as demand returns, workers and factories are immediately available to return to work. And COVID left many jobs to bring back. Houston’s return has been right in line with the deep lockdown losses and post-pandemic recovery seen across the nation which, above all, mostly reflects the depth of losses forced by COVID lockdowns.

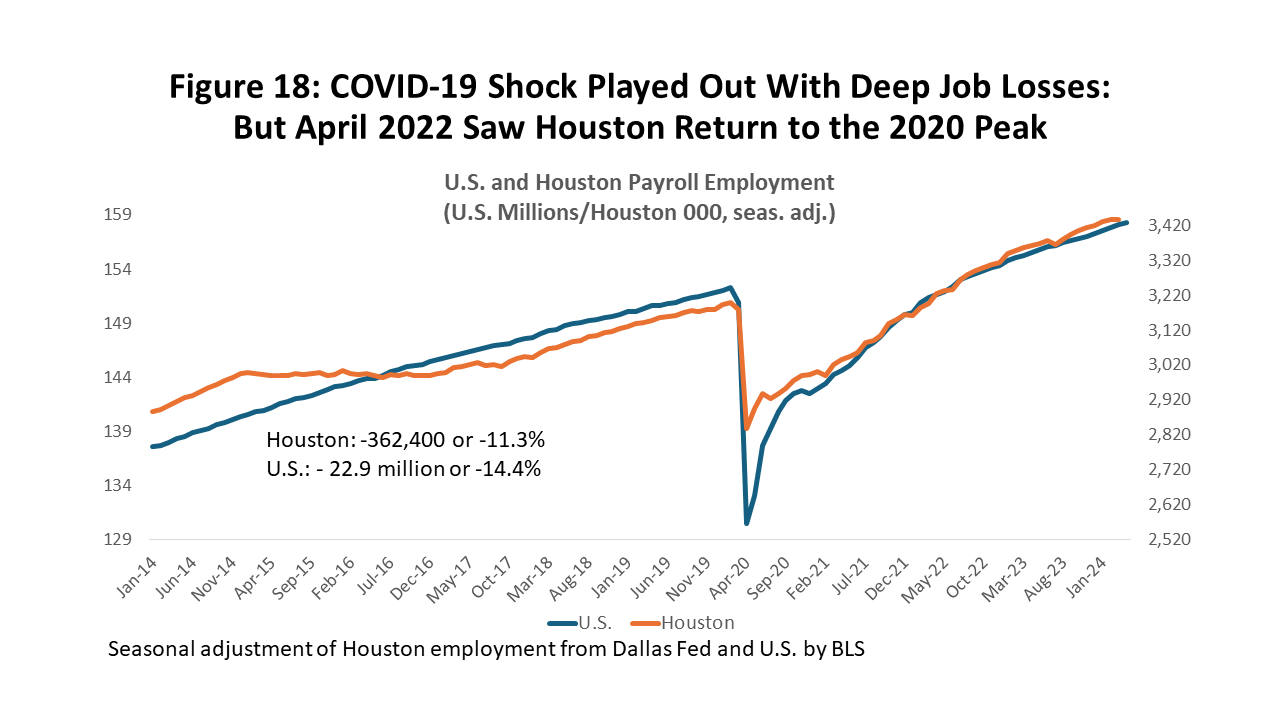

The big picture on Houston’s payroll employment losses and recoveries is shown in Figure 18, with a two-month lockdown decline of 362,400 jobs or 11.3 percent. This compares to 22.9 million US jobs lost or 14.4 percent. Houston’s decline was smaller thanks to a less restrictive lockdown policy in Texas, and the stronger initial US recovery was a strong bounce back as heavier COVID sanctions were lifted. However, for the long recovery phase, Houston and the US were on virtually the same track.

By April 2022, Houston had added back all of the lockdown losses, plus another 223,400 jobs through this April. This doesn’t just mark the gains since April 2022, but also the gains since February 2020 just before the pandemic began. Measured over the longer period, Houston has grown 53,600 jobs per year, or a pace still running below trend. Figure 18 shows a broad slowdown in recent job growth as both the US and Houston curves slowly flattened through 2023 and 2024.

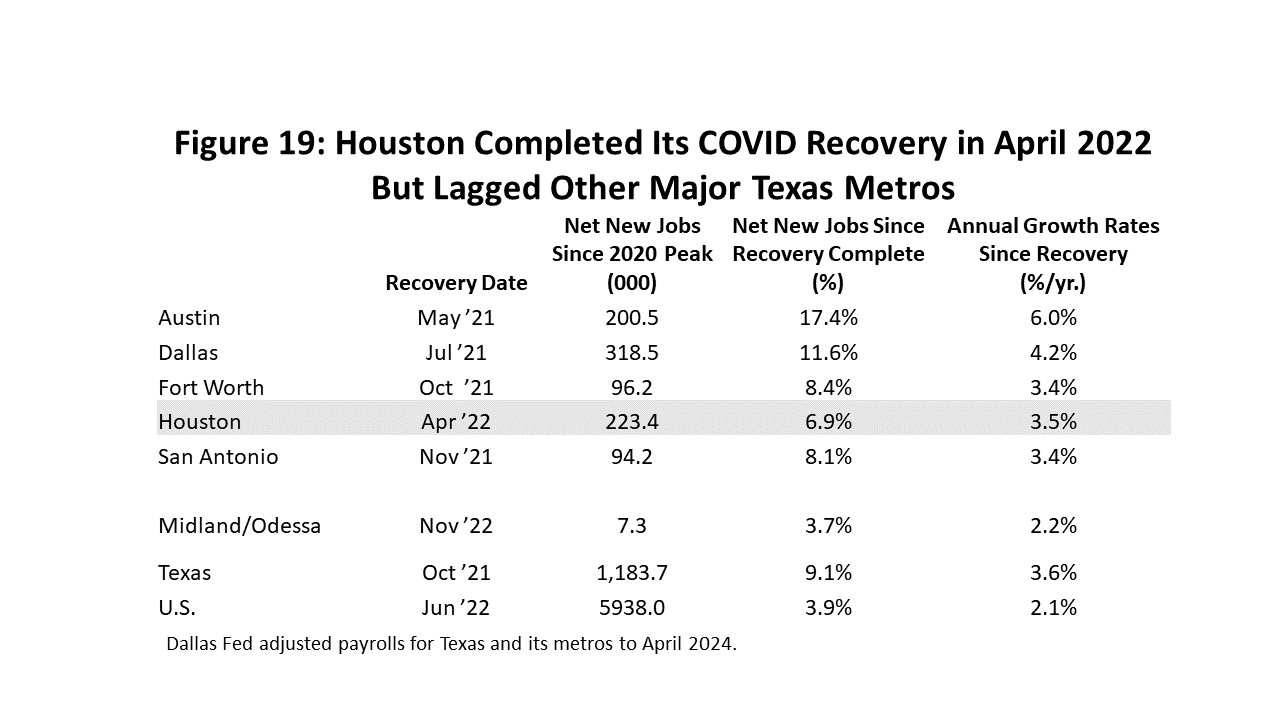

Among major Texas metro areas, Houston lagged all of them in the post-lockdown recovery until recently. We were the last of the Texas Triangle metros to recover jobs and the slowest growing until the last few months. (See Figure 19.) With help from a surge of growth stronger than the US through much of 2023, our post-COVID growth rate finally caught up with and passed Fort Worth and San Antonio. We still lag the state by a small margin and continue to lag both Austin and Dallas by very wide margins.

Why so slow in Houston? The answer is oil and the oil crisis brought on by the Saudi-Russia oil war. The Midland-Odessa metro area is by far the state laggard, even as fracking has found new financial footing. Extrapolate the Permian Basin’s slow growth into Houston’s large oil sector and any riddle about Houston’s slow pace is quickly solved.

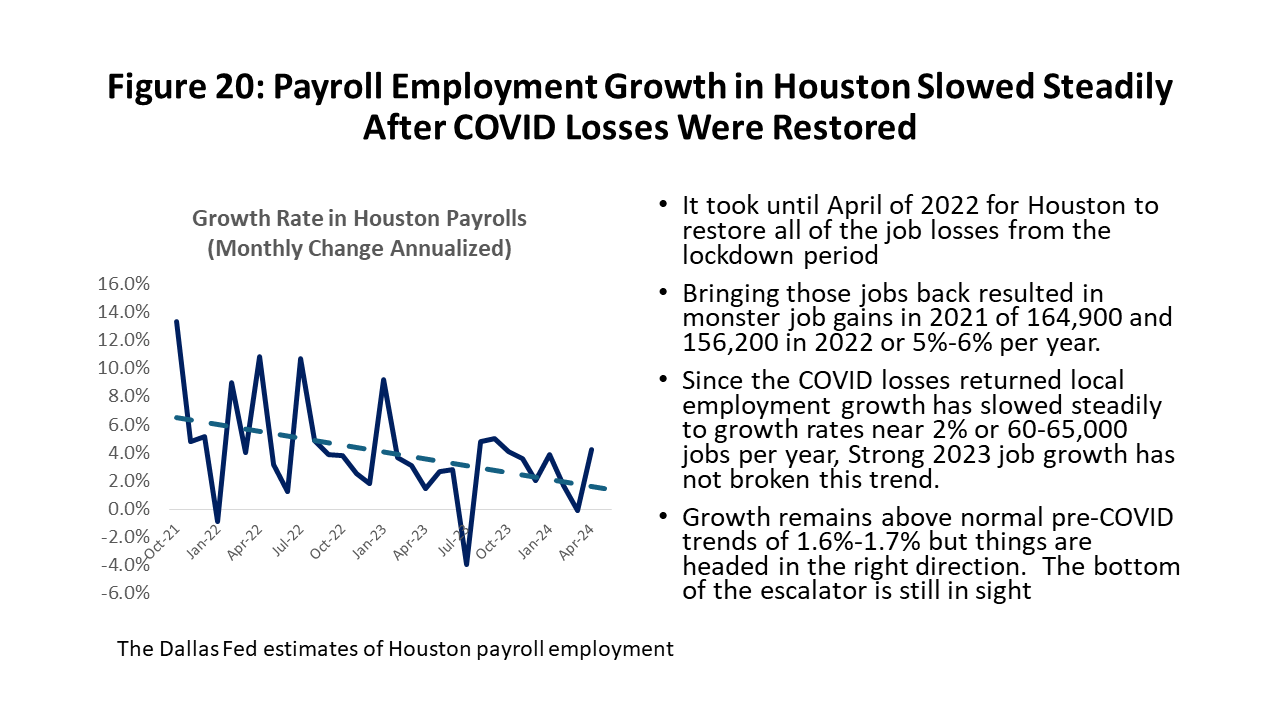

Another look at Houston payroll employment is shown in Figure 20, one that tracks percent changes in jobs from early 2022 to the present. This is like the US escalator ride for the US in Figure 1, except there is no employment surge in recent months. There were major upward revisions to job growth late last year, but nothing that disturbs the picture of Houston taking the long escalator down and walking off into a likely soft landing.

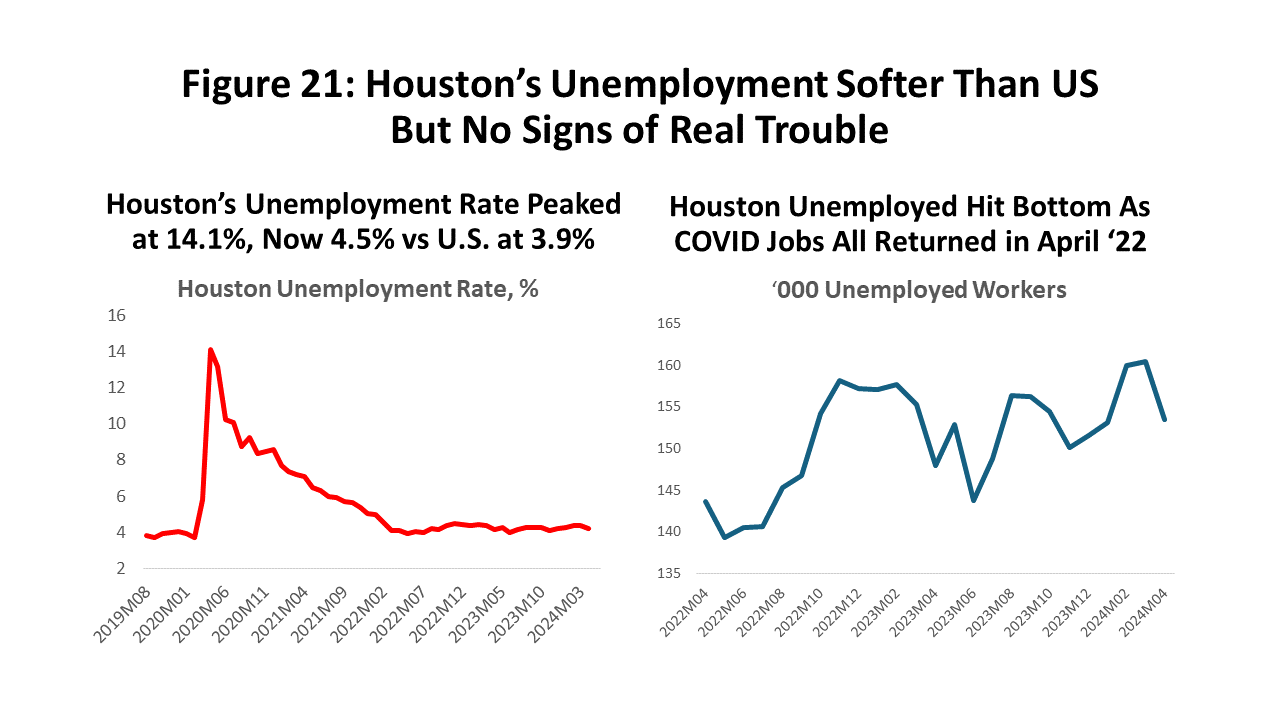

The next few slides look under the hood of Houston’s economic engine, and they consistently show growth that is slower than the US, but also shows few signs of significant trouble. Figure 21 is a good example. After peaking at 14.1 percent in the pandemic, Houston’s unemployment rate in April was 4.5 percent compared to 3.9 percent in the US. The rate has been stable since late 2022.

The right side of Figure 21 shows a 2022 jump in the number of unemployed in Houston, but this likely reflects only the end of the big stimulus programs – including large supplements to unemployment compensation -- in late 2021 and early 2022. Local unemployment rose to 155,000 and has not since moved much above that level.

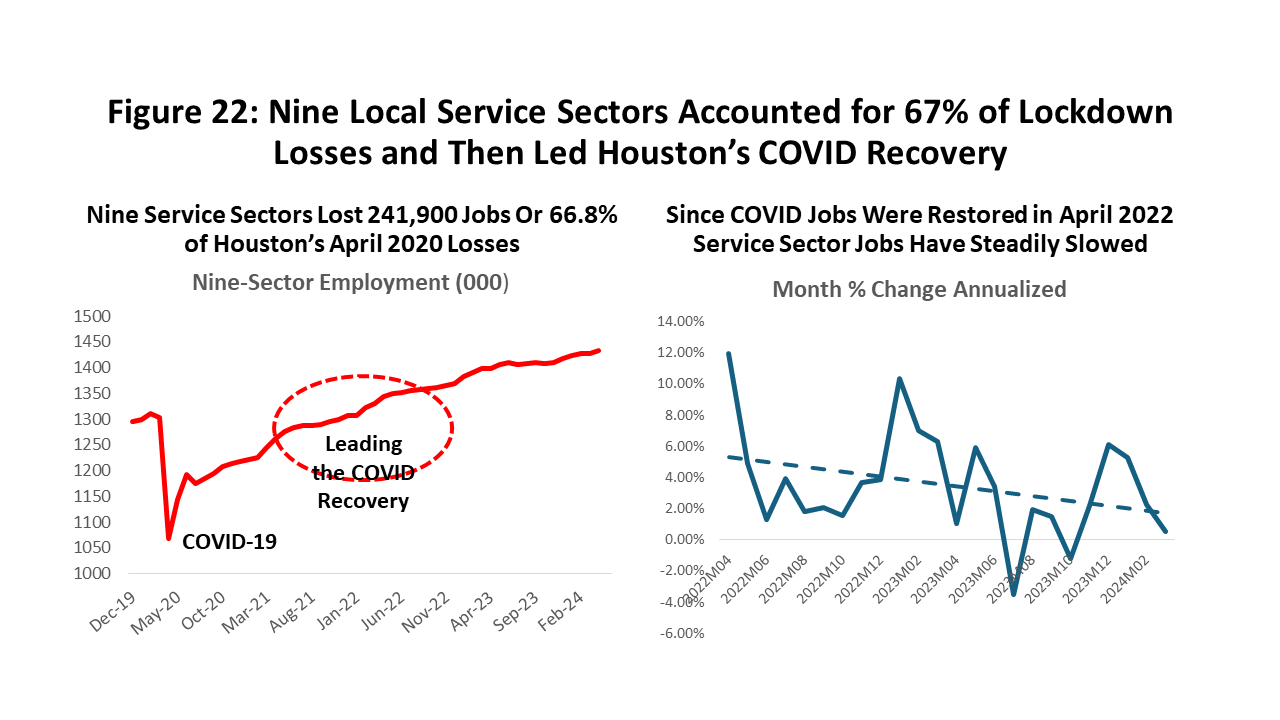

Figure 22 shows a combined nine service sectors in Houston that include 1.4 million workers or 42 percent of Houston’s 3.3 million jobs, with large sectors like health care, retail trade, food service, and finance. These services played a particularly important role in the early stages of COVID, accounting for two-thirds of the lockdown losses because they often required close personal contact and resulted in reactive or mandated social distancing. The jobs then bounced back strongly beginning in early 2021, leading the local economic recovery, spurred by the second and third rounds of stimulus and COVID vaccinations that allowed social contact to resume.

The right side of Figure 22 is another escalator ride down, but now for services instead of total employment. The surge in local service jobs came in late 2021 and early 2022. Trend growth is about two percent and headed lower.

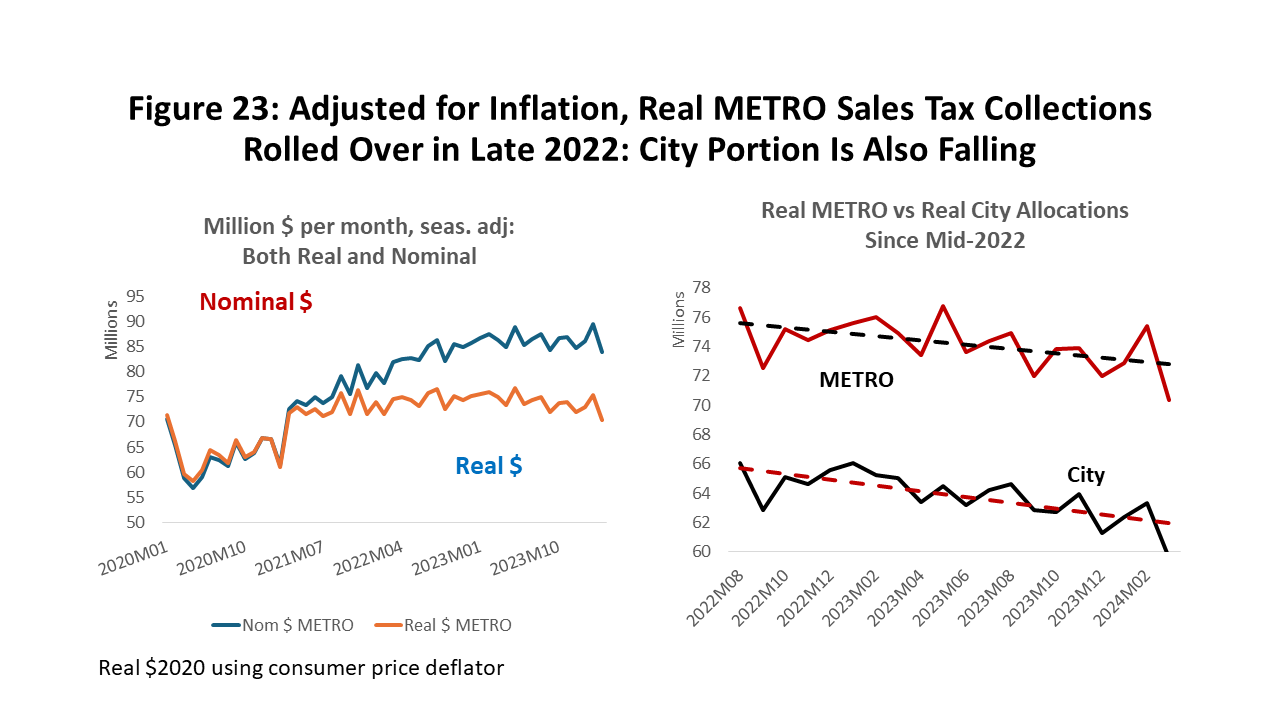

If you look back at US retail sales in Figure 7 and compare them to METRO MTA sales tax collections in Figure 23, in many ways they are a mirror image of each other. Like the US total spending, the 2020-21 stimulus payments brought a sharp one-time jump in METRO sales tax collections that reached 20.9 percent or $11.9 million over the two-month period following the third round of stimulus. Given a one percent tax rate, this is equivalent to an additional $595 million dollars monthly in METRO taxable sales.

We finally see emerging weakness in post-COVID spending levels. Even adjusted for inflation, these tax revenues yielded little ground to this one-time surge until early 2023. Like the US, Houston’s consumers relied on past high levels of liquidity to keep spending artificially high. Unlike the US, in early 2023 local inflation-adjusted spending began to slow steadily.

METRO MTA collections include all of the City of Houston plus broad areas of the suburban metropolitan area. The City has fallen a little faster than the METRO service area, suggesting greater strength in the more affluent suburbs.

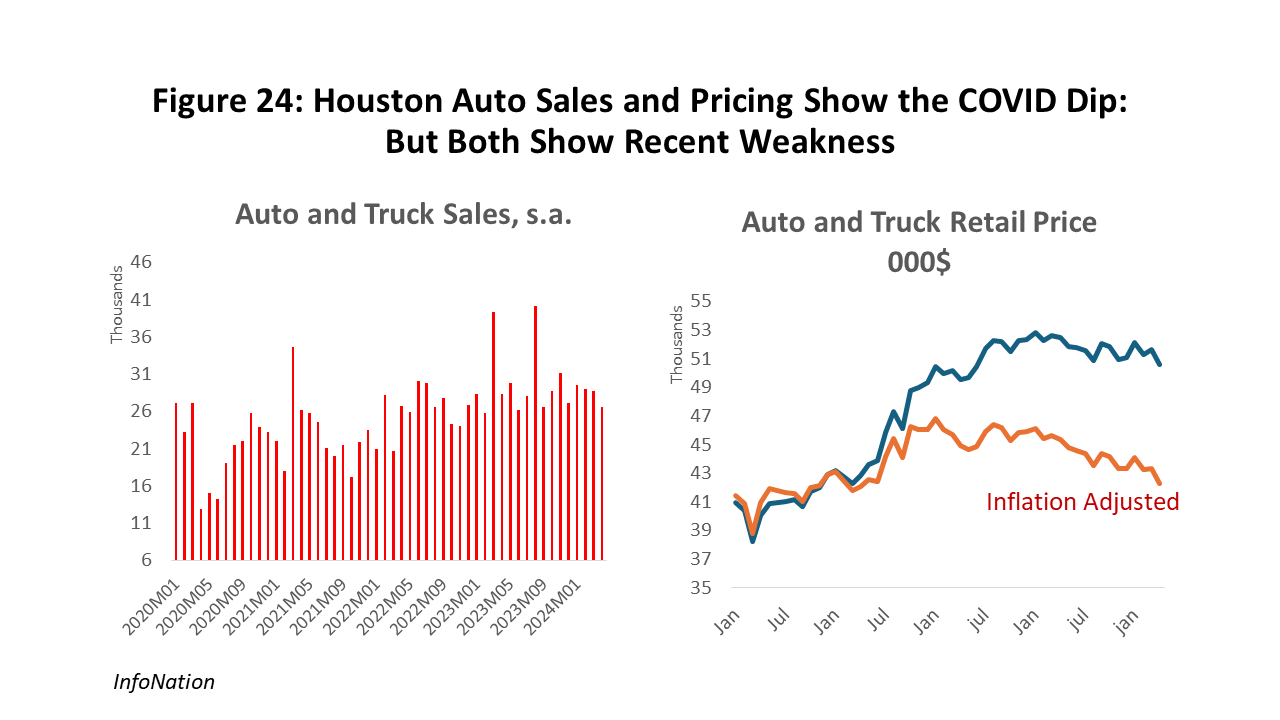

Autos and housing were affected in different ways by the pandemic and responded differently. Autos for example struggled in 2021 and 2022 to deliver product due to chip and other material shortages that choked supply chains and made price the major outlet for surging auto demand. (Figure 24) The big supply kinks now have been worked out, local auto sales rose through late 2022 and early 2023 but are now falling and expected to fall further this year.

Auto and truck prices remain high – still about 25 percent above pre-COVID levels – but prices peaked in early 2023 and have been falling slowly even if we ignore inflation. Once we recognize that inflation is up by nearly 20 percent since 2021, real prices for autos have been falling steadily and are now only 3.6 percent higher than pre-COVID levels.

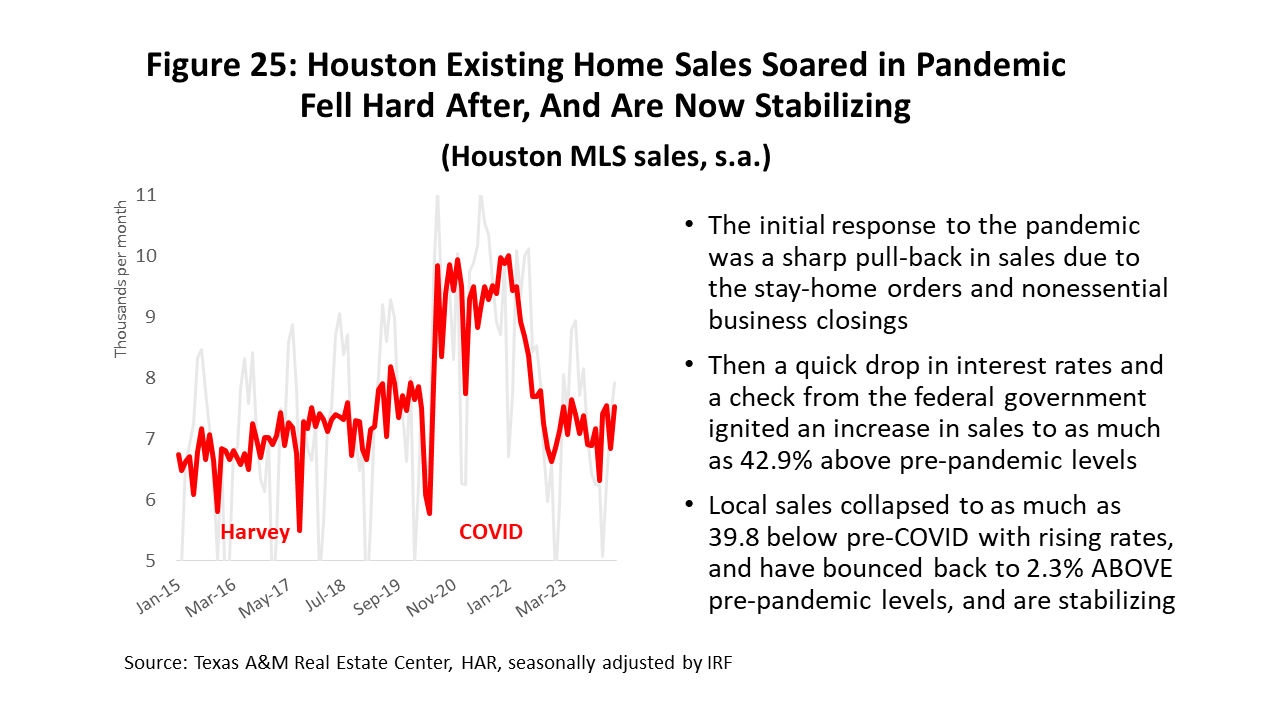

Existing home sales were a local pandemic bubble that would burst as mortgage rates began to rise in 2022. (Figure 25) Existing home sales in Houston fell hard during lockdown months but recovered quickly with a check from the federal government and zero interest rates. Housing became a major element of the 2021 financial boom. Sales in Houston rose as much as 42.9 percent above pre-pandemic levels, only to fall hard after the Fed rate hikes began. Sales briefly fell 39.8 percent below pre-COVID levels in 2023, but they have now recovered to 2.3 percent above pre-COVID levels and remain on hold until interest rates begin to fall.

Existing home prices surged from $250,600 for the typical unit to $343,500 during the boom period, or by 37.1 percent. So far, sharply falling sales have pulled prices back by only 2.6%. Like autos, inflation counts for a large part of the surge in home prices, and local history says prices could hang on to a big part of the remaining gains in years to come. However, such an outcome would likely mean a decade or more of small home price appreciation.

Houston’s Economic Outlook

With COVID behind us, 2024 has seen economic fundamentals return to the driver’s seat as oil and the US economy take control. While signs are emerging that the policy hangover from fiscal and monetary stimulus is disappearing, both the US and local economy are headed to a soft landing. A surprise extra 32,800 jobs in Houston for 2023, from revisions by the Texas Workforce Commission, brought the annual total to a very strong 102,900, but there are numerous signs that local employment growth and consumer spending are now slowing. We think the slowdown will stabilize at healthy levels, bring a soft-landing, and put us on a track to normal trend growth.

The chief drivers of Houston’s job growth outlook are the US economy and oil markets. Our earlier discussions of both are summarized in Figure 27. Fed monetary policy plays a key role in the outlook, and we assume that the Fed carefully sticks to its inflation targets. And we assume election-year politics do not result in explicit efforts to pump up the economy. We follow the Survey of Professional Forecasters assumptions that the US makes a quick return to trend growth.

The new financial model for large public oil companies is widely implemented, assuming 30-40 percent of producer cash flows are diverted to stockholders to finance drilling. The result is a smaller and more stable upstream oil industry in Houston. High oil prices near $80 continue through this year, providing a boost to local employment.

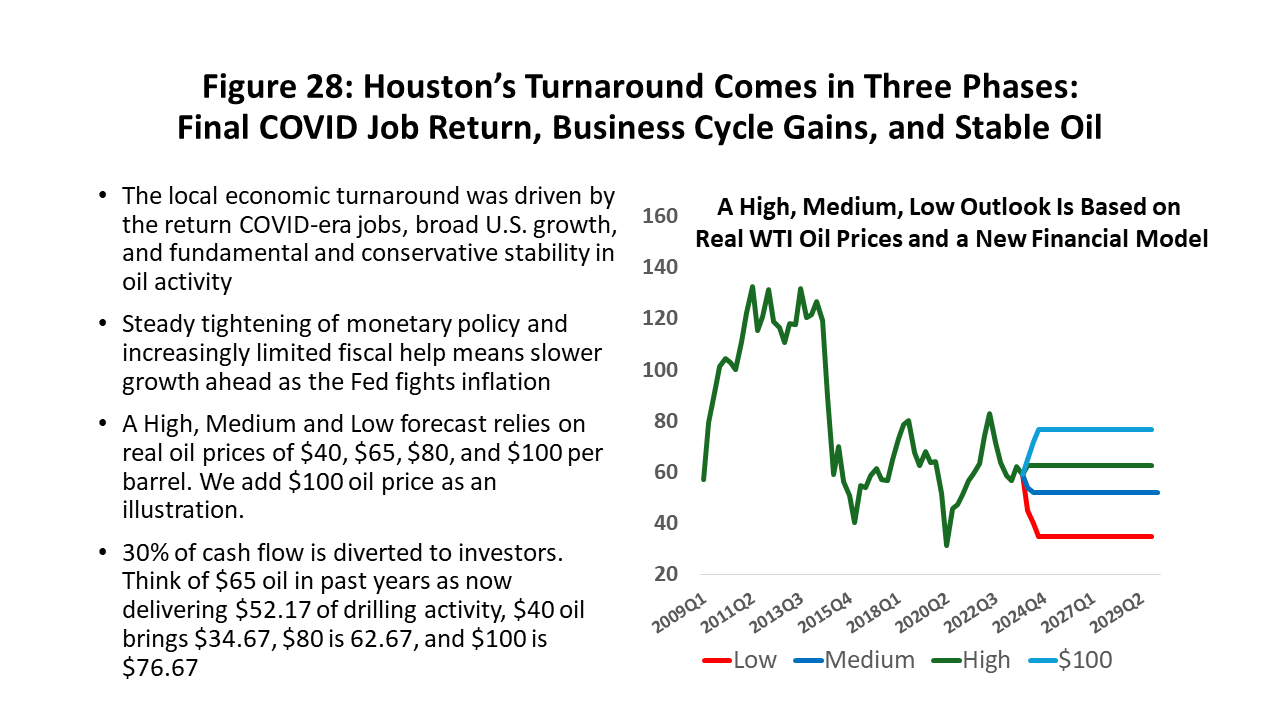

To pull the forecast together, we use a high, medium, and low outlook for planning purposes. (Figure 28) We use the price of oil as the vehicle to spread the outlook from low to high employment levels. For current planning, the low oil price is set near $40 per barrel and the high at $80. The medium price is $65 per barrel or the long-run marginal cost of oil. In all cases, we use the new financial model with 30 percent of operational cash flow diverted to investors or else used to strengthen the firm’s finances.

Oil prices likely remain above $70 per barrel just as they have since late 2021, with prices near $75-$80 through the rest of 2024. Any further projection of oil prices is highly speculative, and a return to $65 per barrel is the best guess in 2025 and after. This smaller and slower-growing oil industry reduces our expectations for oil-field expansion and now implies slower regional growth than similar prices would have brought in the past.

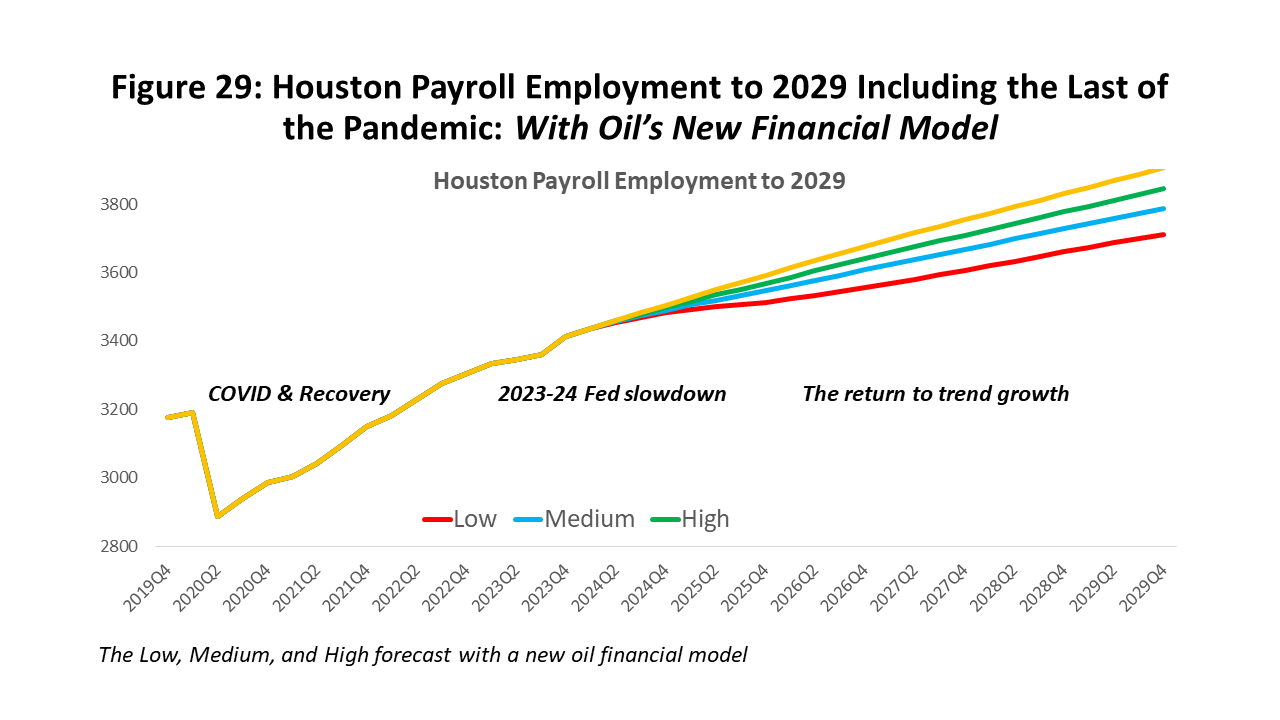

Figure 29 is an overview of how economic fundamentals play out over the longer run for low, medium, high, and $100 cases. This is our forecast of Houston’s economic future through calendar year 2029. We see the COVID lockdowns end, a long recovery to pre-pandemic employment levels and beyond, a moderate acceleration this year helped by momentum from strong growth late in 2023. Houston then returns to the basics in 2025 and beyond, settling into trend growth near 55-60,000 jobs each year.

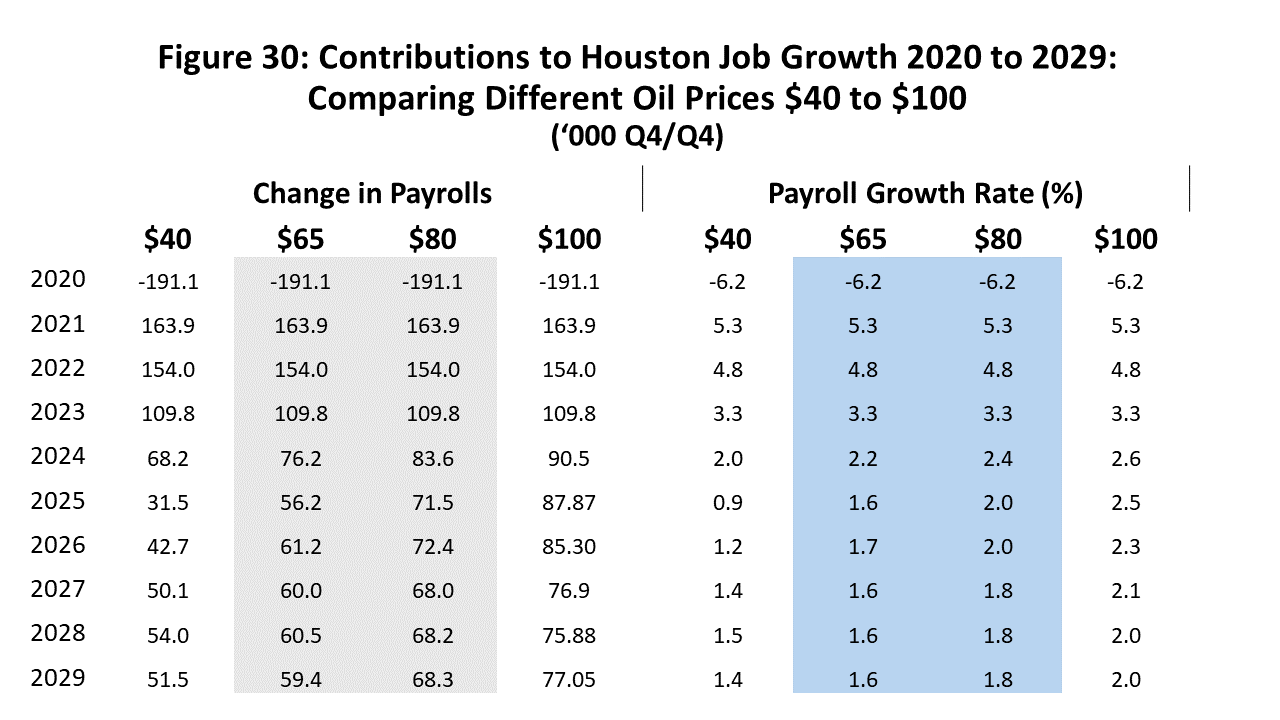

Figure 30 is the 2024-2029 forecast of Houston’s payroll employment stated in annual changes and measured Q4 over Q4 each year. The outlook in 2024 should be closer to 80,000 jobs and between the medium and high forecasts if oil averages between $75 and $85 per barrel -- as it has for the first half of the year. Trend growth then follows.

Written by:

Robert W. “Bill” Gilmer, Ph.D.

May 21, 2024